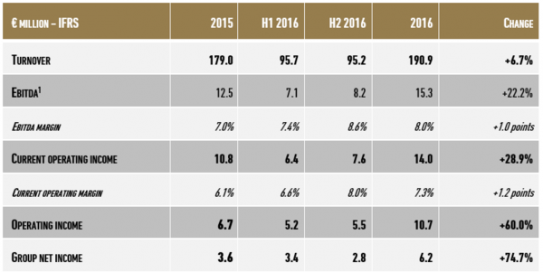

2016 Net Income: 75%

The robust growth seen throughout 2016 combined with the programs in place to improve margins have brought SQLI Group's Ambition 2016 plan to a satisfactory close.

SQLI’s consolidated financial statements were approved by the Board of Directors at its meeting on 16 March 2017. The accounts have been audited and the certification report will be issued once the procedures required to publish the company’s annual financial report have been completed.

Growth: +6.7%

SQLI Group's strategy delivered growth in high value-added segments in 2016 as technical performance activities focused on business margins rather than business volumes. Operations overseas grew 16%, with e-commerce accounting for 54% and mobility for 55%.Marginal activities with a low value-added were terminated.All told, the Group posted growth of 6.7% (7.5% excluding the purchase of new premises).

Current Operating Income: +28.9%

Boosted by the increase in the Group's strategic mix (increase in digital activities) and international operations, SQLI's Ebitda came in at €15.3 million. Current operating margin increased substantially to 7.3% of turnover (6.1% in 2015), amounting to 6.6% for the first half and 8.0% for the second which is in line with the targets of the Ambition 2016 plan.The improvement in the employment rate to 85.8% at year-end also contributed to the increase in margins.

Operating Income: +60.0%

SQLI's operating income amounted to €10.7 million in 2016. Non-current expenses totaled €3.2 million and included €2.3 million in restructuring costs and €0.8 million in non-current costs linked to acquisitions.

Net Income: +74.7%

After -€0.4 million in financial income and a tax expense of €4.1 million, SQLI Group net income amounted to €6.2 million for 2016.

Net Financial Debt: 7%

€11.8 million in cash flow generation over the year enabled SQLI to finance its growth and continue to invest in the transformation of the company.The Group has a healthy balance sheet, with a gross cash position of €9.6 million and net gearing of 7%.

Following the close of the year, SQLI negotiated access to additional financing of €40 million, and has €32 million in outstanding warrants and options and authorized credit line drawdowns. These resources will allow the Group to pursue the ambitious external growth planned as part of its Move Up 2020 program.

SQLI's Board of Directors will recommend the payment of a dividend of €0.88 per share at its next Annual General Meeting (€0.60 per share in 2016).

Outlook For 2017

The last quarter of 2016 and first trends in 2017 point to a positive start to Move Up 2020. SQLI's growth engines are ready to move up a gear with the increase in major accounts and the Group is actively seeking to broaden its geographical footprint through acquisitions.It has set itself a target of a double-digit increase in turnover thanks to sustained organic growth and new impetus from external growth, and is also targeting another significant increase in Ebitda in 2017.

SQLI will publish its 2017 first-quarter turnover on 11 May 2017 after the close of trading.

1 Ebitda = current operating income + net depreciation and amortization and provisions.2 (Financial debt – Cash) / Equity2