Thanksgiving and Black Friday: A look back at the online shopping madness

Over the last few years, the big American family holiday has become the big shopping holiday. “Thanksgiving”, “Black Friday”, “Small Business Saturday” and “Cyber Monday” are the key words of the period starting on the 4th Thursday in November every year.

A few US online shopping statistics

The following figures are from Adobe Analytics, which measures the transactions of 80 of the 100 main US online retailers.

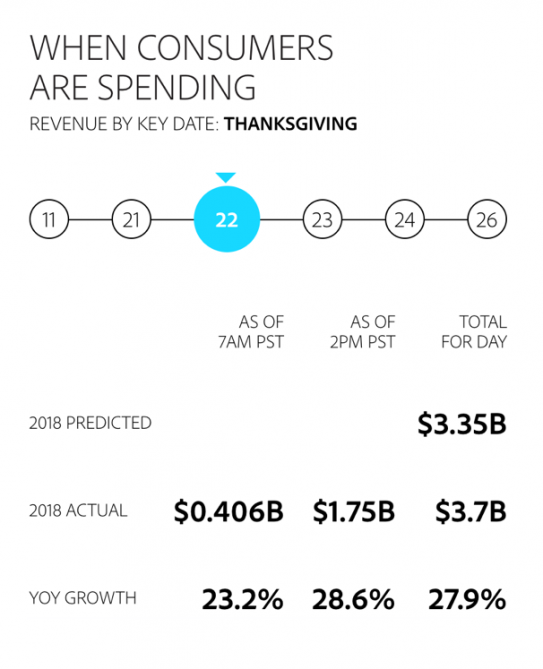

Thanksgiving

Online spending for Thanksgiving 2018 hit $3.7 billion. i.e. nearly 28% up on 2017 (18.3% between 2016 and 2017). This is the highest growth seen since 2014.

One reason for this is that many retailers have changed strategy, by charging the same prices on Thanksgiving Day and Black Friday for the first time. Average order value was up 8% on Thanksgiving Day 2017.

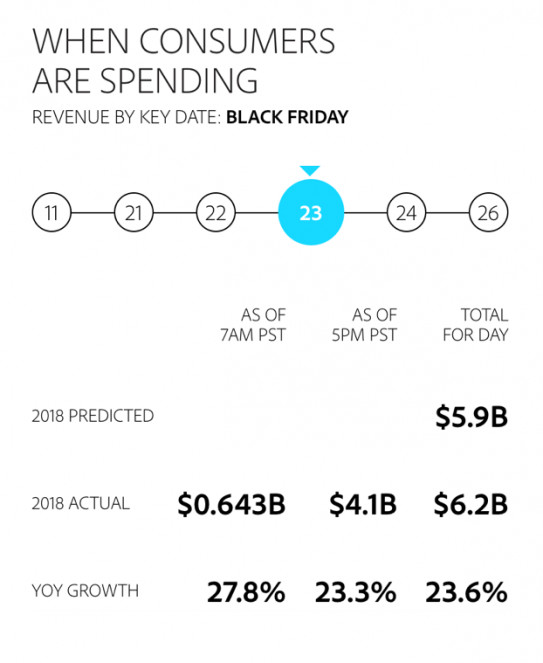

Black Friday

On Black Friday, online sales were up 23.6% on 2017, hitting $6.2 billion. More than $2 billion of this revenue came from m-commerce. Average order value was $146, up 8.5% on 2017.

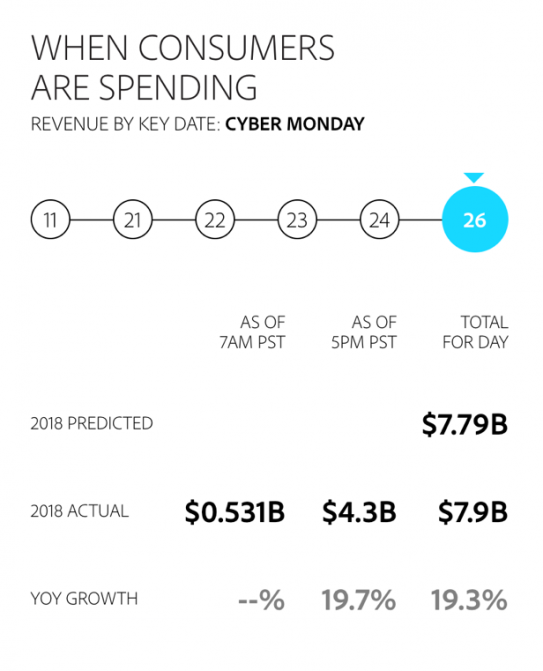

Cyber Monday

This day of online sales was the biggest of 2018 with revenue of $7.9 billion, up 19.3% on 2017. Mobile transactions made up more than half of visits (54.3%), up 55.6% year on year. Amazon issued a press release saying that it had sold more items on Cyber Monday than on any other day in its history, including Prime Day 2018.

Via http://exploreadobe.com/retail-shopping-insights/

Who was the winner over this period?

The in-store shopping frenzy during Black Friday seems to have subsided. People don’t queue outside stores early in the morning to be the first in any more. What’s more, many brick-and-mortar stores aren’t open on Thanksgiving or are only open certain hours. So customers make do with buying using their smartphones.

Nevertheless, online buying still hasn’t eliminated the traditional trip to the shopping centre… A lot of buyers go for click-and-collect on Black Friday. In addition, despite the unusually low temperatures seen across much of the US, footfall in stores during Thanksgiving and Black Friday fell by only 1% in 2018 according to ShopperTrack estimates. So online buying and click-and-collect remain a popular option, up 73% for Thanksgiving and Black Friday, according to Adobe. Target, Macy’s, Kohl’s and Walmart are just a few of the stores that offered this option. Their strategy? Encouraging additional in-store purchases when customers come and pick up their orders. According to the International Council of Shopping Centers, 64% of consumers using click-and-collect made an additional in-store purchase. Cyber Monday also saw peak click-and-collect rise by 65% between 2017 and 2018. What if the big winners of these online purchases were brick-and-mortar stores?

How about in the future?

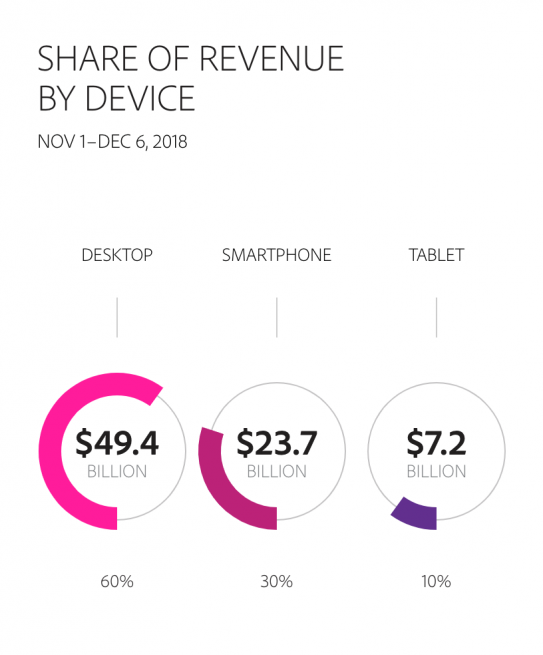

Again, according to Adobe Analytics, $80.3 billion were spent online on 6 December 2018, which made it the biggest e-commerce period of all time in the US.

This spending was up 18.6% on 6 December 2017 and beat last year’s record by nearly $13 billion. Adobe estimated that for the whole 2018 holiday period (from 1st November to 31 December), there would be at least $124.1 billion in online retail sales in the US. These figures clearly show that stores are reaping the benefits of their investment in mobile sales and that the future of retail really does lie in an omnichannel approach.