How is omnichannel banking taking shape?

Digital technology is changing the way consumers do banking worldwide.

While the degree to which digital technology is being adopted varies, basic transactions in banks are increasingly migrating from physical channels to digital channels. GAFA (Google, Apple, Facebook and Amazon) is also increasingly interested in the banking sector, looking for ways to get involved and create value. The omnichannel approach is now at the core of most banks' strategies as new customer behaviours are strongly influenced by innovation, ease, accessibility and the simplicity of use of platforms provided by fintech companies.

The fact is that many customers have become exclusively digital users, who prefer to prospect, buy and interact through digital channels alone (such as internet banking and mobile banking services). The number of customers in the omnichannel segment has considerably dropped in recent years; it is now being replaced by the omni-digital client, who uses only digital channels.

According to a survey conducted by PwC among online bank customers in 2017, this emerging segment is already huge, representing 46% of the global banking customer base, which has several implications for the strategies to be adopted by financial institutions and establishments.

Customer expectations in terms of banking services are changing in light of the experiences offered by online banks. Most banking establishments are now realising that they must improve the supply of financial services on digital channels in order to keep up with tech companies that have set the quality standard for many new digital customers around the world. This new standard set by GAFA includes unlimited availability, hyper upgradeability, increased personalisation, and unprecedented quality and innovation. All of these dimensions are provided almost exclusively through digital channels.

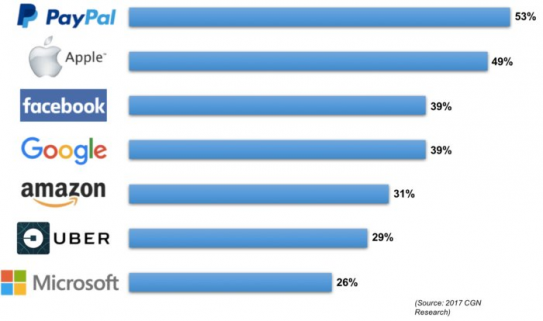

In a recent global survey conducted by CGN Research & Advisory Group, analysts detected some astonishing market data. They asked participants the following question: "If some of the best-known tech companies provided banking services, how likely would you be to bank with them?" The table below shows the results:

Given that most consumers can access their bank(s) via their smartphones, computers and tablets, actors in the finance sector must reflect more on how this change impacts the development and provision of products and services. The key is for them to know how to differentiate themselves through digital platforms in order to gain a competitive advantage and win market share from fintech companies.

In the United States, leaders such as Bank of America, CitiBank and Chase are showing the way.

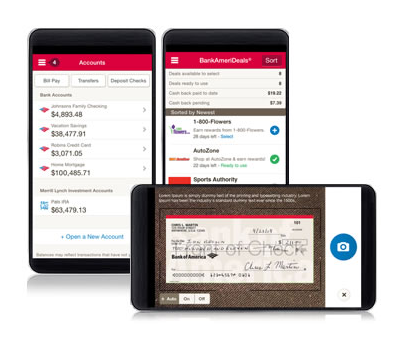

Bank of America is taking its omnichannel development very seriously. In their mobile app, customers can manage appointments, cheque deposits, card requests and, of course, bill payments. The experience is the same whether they use a smartphone or computer.

However, users cannot yet request loans or carry out other, more complex banking transactions using their smartphones. Banks are looking to make up lost ground in their customer relationship by opening Labs and developing their mobile apps. However, the proposed innovations are not yet sufficient to be seen as a major advantage that will attract demanding customers.

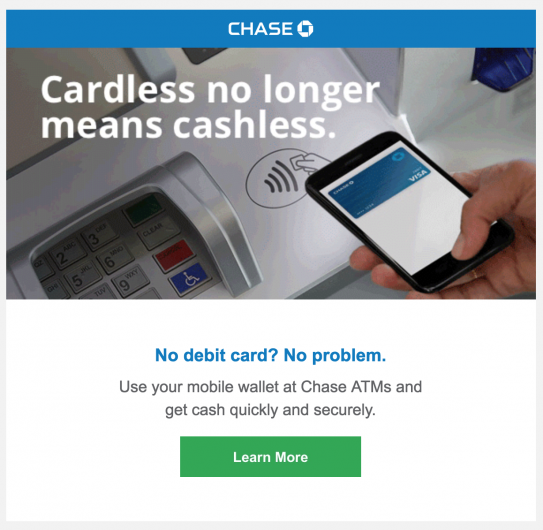

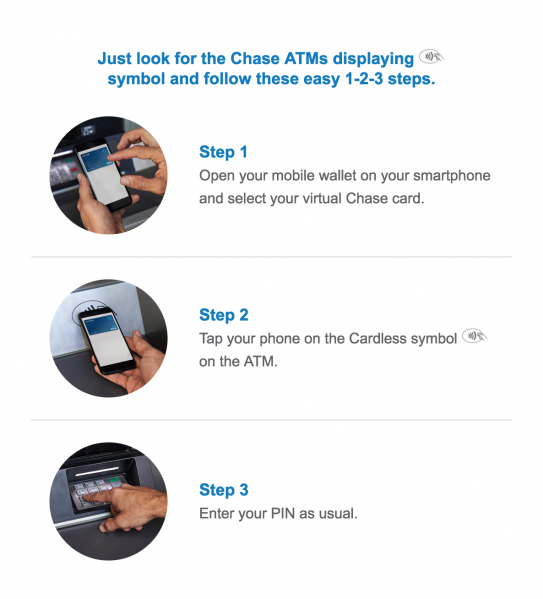

Following Wells Fargo, the bank Chase has enabled customers to make ATM withdrawals without using a card. They simply use the bank's mobile app and tap the 'Cardless' symbol on the ATM with their smartphone. To withdraw cash, they simply enter the bank card PIN to access the regular ATM menu. This is an example of an improved customer experience that makes it easier to access banking services.

Furthermore, in order to increase use of its Chase Pay app, the American bank has established a partnership with Shell service stations that offers customers discounts on purchases. The idea is simple: when customers arrive at the service station, they open the mobile app and enter the pump number in the Pay tool.

They then receive a unique code on their smartphone, which they enter on the pump's screen, giving them a discount of 35 cents per gallon (approximately 3.8 litres). Given that a gallon of fuel costs around $3, this is a very interesting proposition and enables Chase to offer its customers a real omnichannel experience.

U.S. Bank aims to shape the future of banking with voice assistants and ambient computing. Digital assistants are currently the most recognisable devices in ambient computing, and U.S. Bank recently became the first bank to provide services on the three main platforms: Amazon Alexa, Google Home and Apple Siri.

The use of voice banking is in the early stages. However, it is set to expand and become increasingly integrated in digital efforts in the sector over the coming years.

All three digital assistant platforms can provide customers with the balance of their current, savings and share-trading accounts, while Alexa and Google Home also communicate bill payment deadlines and the details of recent transactions. Alexa can also help customers settle their monthly credit payments using an American bank account. The bank has also added additional security measures, such as authentication of account settings and a four-digit PIN to protect the confidentiality and security of customer data.

Digital assistants do not store customers' secure data, such as PINs, account numbers or other identifiable data. Transactions performed with voice assistants are protected by U.S. Bank's online risk-free guarantee, which ensures that the bank will cover 100% of losses caused by unauthorised transactions, provided the bank is rapidly informed.

In the future, voices themselves will be the password to access tools. However, U.S. Bank's mobile app remains the hub of digital interactions with its customers.

Omnichannel banking in other parts of the world

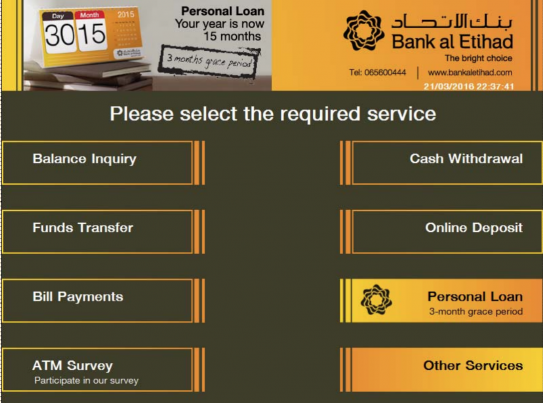

Bank al Etihad is one of the main banks in Jordan. It was aiming to offer a much wider range of innovative products at ATMs. It first looked at expanding its range and target specific customer segments with loans that would be immediately available at ATMs. This is because the bank was missing out on loan sales opportunities when it was closed.

BankWorld ATM is an ATM software solution developed by CR2. Among other things, it enables bank customers to automatically take out loans via ATMs, without the need for manual operations. With BankWorld, customers are pre-approved and receive a loan proposal that they can accept directly via the ATM. BankWorld then automatically processes the request. The loan amount is pre-determined by the bank according to the customer segment and the terms and conditions agreed to at the ATM. The sum can then be disbursed on the spot or transferred to a selected account.

Image via http://www.cr2.com/media/608382/bank-al-etihad-omar-essa-atm.pdf

Thanks to fast loans at ATMs, Bank al Etihad can offer loans 24/7, increasing the acceptance of loans by the bank and generating new revenue streams from its existing ATM network. Customers are also satisfied with the fact that face-to-face meetings are no longer required, in particular for small loans, as they represented an obstacle previously.

Financial establishments have always focussed on transactions in branches, as opposed to actions concerning customers. With an omnichannel approach, banks and credit unions can provide targeted advice, products and services to customers via all distribution channels (including the web, smartphones and ATMs), or when customers visit a branch.

Banks that adopt an omnichannel approach encourage these financial organisations to closely follow customer purchasing behaviours, preferences and choices, according to the various channels and devices, by creating an agile IT infrastructure to support customer-centric innovation.