What Tactics Are US Banks Adopting to Attract Millennials Into Their Branches?

Millennials are the target market that the vast majority of firms are most focused on. In the US, financial institutions are showing great imagination to attract these customers into their branches for commercial purposes.

So, how do they try to win over this particularly demanding group? According to a FICO survey, Millennials would rather use mobile applications than go into a branch to manage their bank accounts. But the branch is the cornerstone of customer relations, so banks must maintain a physical distribution network. Here are a few examples of initiatives introduced to attract more customers into branches.

Accelerating current operations to allow more time for high-added-value operations

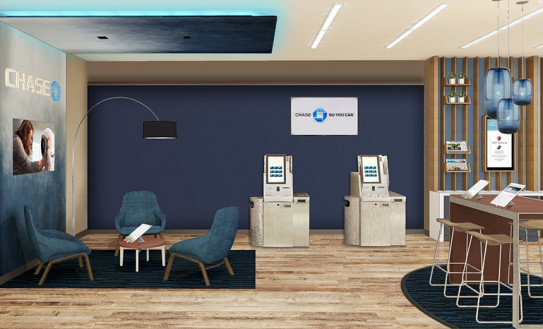

Chase Bank - Everyday Express

Chase bank recently inaugurated new-model branches; Everyday Express. These simplify standard operations such as withdrawals and deposits of funds via a more compact and digital branch format. These digital tools allow physical branches to adapt to self-service practices (4 out of 5 transactions use self-service channels). This branch format is also focused on financial and asset management advice, distancing itself from the purely transactional element; Millennials are more open to discussing their financial objectives face-to-face. They can chat over a coffee with advisors on site or use the video-conference space to discuss more complex issues with an experienced advisor. In fact, this age group could do with better assistance to manage their assets as even though they regularly invest their money (71% of Millennials are saving for their retirement), they're still averse to investing in the stock market, even though this offers the advantage of quickly boosting their savings.

Betting on cardless withdrawals

At Wells Fargo, efforts are focused on the smartphone, which is crucially important in relations with young customers. In fact, 72% of consumers aged from 18 to 34 years old regularly use their financial institution's mobile application. In 2017 it launched a cardless withdrawal service. This system works using the Wells Fargo mobile application; a single-use code is issued and the user only has to type it into the ATM to withdraw the amount they want. The bank has equipped its 13,000 ATMs in the US with this technology and plans to add NFC as a cardless withdrawal tool in the near future. Millennial consumers are big fans of digital technology. In their eyes, banks should offer choice, convenience and customisation. Banks that understand and know how to meet these needs have a clear competitive advantage in a fast-changing market.

Cardless ATM - Wells Fargo

Making the most of a friendly café atmosphere to make a point

Café capital one

At Capital One, the aim of the game is to make customers feel at home. So, the bank decided to extend its network of Capital One Cafés: the first two were inaugurated in New York and Austin during the SXSW festival, as attended by SQLI Lab. In these new branches, customers can set up shop in a relaxation area for managing current operations and get financial information but also meet people over a coffee, use the WiFi to work, and attend bank coaching sessions and other workshops. By creating a relaxed atmosphere, Capital One wants to show that the bank can adapt to the lifestyle of Millennials and, as a result, understand their financing and investment needs.

Watch a video about the Austin café

Opening the doors of its innovation centre to the general public to detect the best inventions

In Salt Lake City, Utah, America First Union opened its innovation centre to both existing and prospective customers. Anyone can visit this site in the city centre to meet advisors and test all its new developments: private rooms to talk to an expert via video-conference, new ATMs to carry out more operations without human assistance, or even connected tablets to check out banking offers and mobile applications, which can also be tested on users' own smartphones. In addition to highlighting everything it has to offer and the future of bank branches, having these innovations tested also allows America First Union to observe visitors, get their opinion, and, as a result, identify areas for improvement. This innovation centre is a perfect tool to analyse the inventions that the customers of the bank of the future are really interested in.

America First union - Innovation center