3 examples of how fintech is changing the face of stock market investment

The US financial markets are the biggest in the world, particularly with the NYSE and NASDAQ stock exchanges. In 2016, the finance and insurance sectors accounted for 7.3% of US gross domestic product. These sectors employed 6.2 million people in 2016.

In 2015, at least 130 of the 500 companies on the Global Fortune list were based in the United States in order to make the most of the country's attractiveness and its creative, competitive and comprehensive financial services. The sector offers the widest range of financial instruments and products to help consumers manage risk, create value and meet their financial meets. The other factor contributing to the success of the financial sector is the fact that many small investors invest directly on the stock markets.

In order to further democratise direct investment, many fintech start-ups have sprung up with the aim of helping individuals to save without going through a bank and investing in businesses and/or crypto-currencies.

Investing simply to save for retirement

The US pension system is, as we are aware, very different to the French one. Many households actually have to save for their own retirement. This means that Americans need a wide range of tools to save for retirement by going through financial institutions, using services proposed by their employers, and now working with start-ups.

One of the most interesting examples is Acorns.

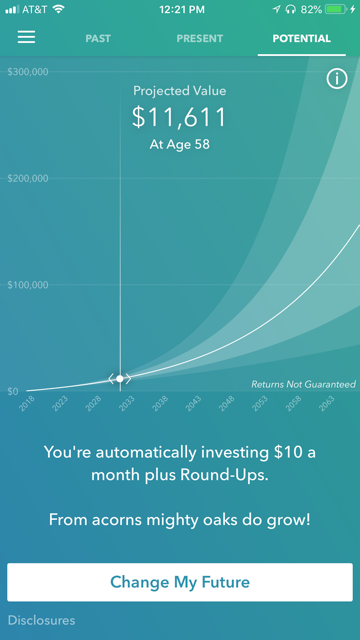

Acorns offers investment by collecting the difference between the price of a product bought with a bank card and the next dollar on behalf of its customers. Example: for a purchase costing $4.53, the 47 centimes needed to top up to $5 are automatically collected and invested on the user's behalf. Using the mobile application, customers can also configure their investment: they can choose a recurrent monthly payment and/or add funds at their convenience.

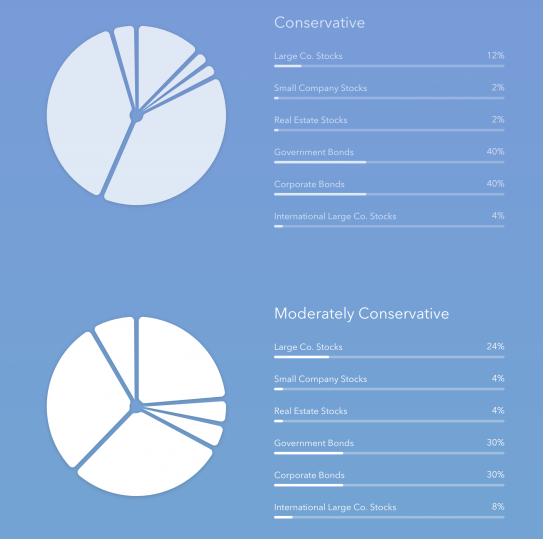

In order to fully meet user needs, Acorns includes a questionnaire in the registration form to identify the user's investor type and the level of risk they're willing to take. The start-up then assigns a score and the portfolio is created based on the investor's profile.

The clear advantage of this solution is the service's simplicity. The customer invests effortlessly and can easily set objectives.

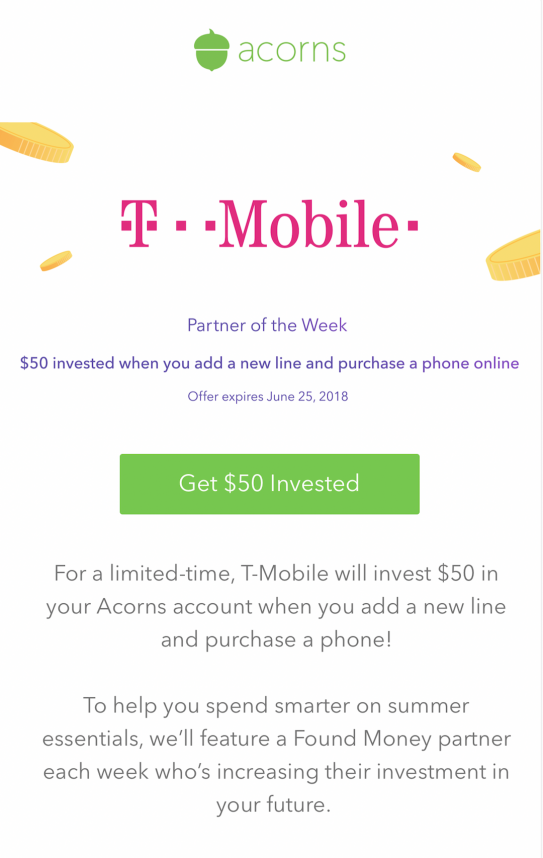

And to go further, the fintech company now offers its own payment card, making transfers to a pension fund even easier. The card allows customers to benefit from advantages based on partnerships with a range of e-commerce sites such as Amazon. Instead of offering reductions, these sites invest part of the cost of the purchase on the customers' Acorns accounts.

SQLI Lab NY's opinion

The US likes to encourage individuals to take charge of their own retirement. Therefore Acorns is an interesting tool for business owners and individuals who really want to take charge of their retirement by keeping an eye on the companies their pension fund invests in. The mobile application is easy-to-use and effective and is expanding with the addition of the Acorns bank card.

Investing in the stock market

Americans who want to invest in the stock market on their own behalf previously had to go through a bank or open an account with a financial institution. They could then personally invest in the companies of their choice.

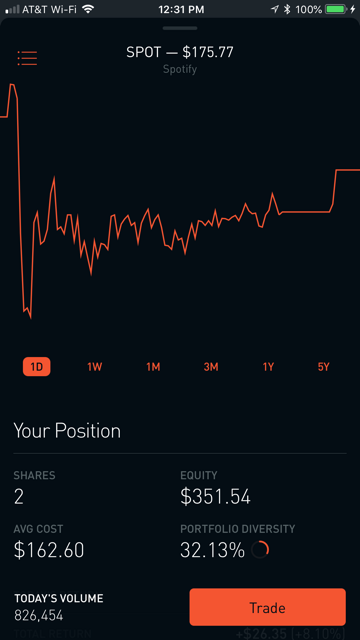

The Robinhood start-up decided to change the rules. The New York-based company, founded in 2015 and now valued at 5 billion dollars, is seeking to revolutionise the sector by offering a solution to private investors, and the basic solution is free, too.

Investing is now just a click away. The application is accessible only to legal residents on US territory and to register, a strict verification process, based on social security numbers, allows access to the service and depositing of funds from a bank account ($50 is enough to start investing). Customers can then simply choose the businesses they wish to invest in.

Robinhood offers, both on its application or website, all the basic information on the volume of transactions, the latest values as well as articles on the stock portfolio to enable people to invest intelligently.

Robinhood currently has more than 4 million authorised accounts. Its business model is simple: subscription to Robinhood Gold. Depending on account size, Robinhood customers can pay between $6 and $200 a month, and get a line of credit of $1,000 to $50,000 to invest in return. So a client who already has $6,000 on their account can, by paying $15 a month, receive $3,000 from the start-up to invest. This is a 0% loan, but it can make clients take more risks in case of bad investments and might make Robinhood request a margin call. The customer then has to reimburse any losses from their own pocket. To develop its customer base, the start-up relies on a referral system. Customers who invite their friends get a bonus stock for every new customer who registers on the site. This means an account can be active without customers having to spend their own money so they can start investing on the stock market without having to pay a cent.

SQLI Lab NY's opinion

One of the advantages of this application: you get a bonus stock when you create your account and invite friends. The other advantage is that it really encourages you to get interested in the investments and the companies you can invest in in a simple and fun manner. Robinhood really democratises individual stock market investment.

Investing in crypto-currencies

In the up-and-coming crypto-currency sector, many start-ups are developing a solution to democratise investment in currencies such as Bitcoin or Ethereum.

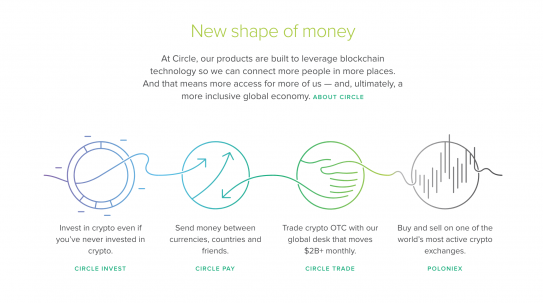

Circle is one of these start-ups

Founded in 2013, the company, partly funded by Goldman Sachs Group Inc., is now valued at 3 billion dollars and offers easier access to investment in crypto-currencies than one of its competitors Coinbase.

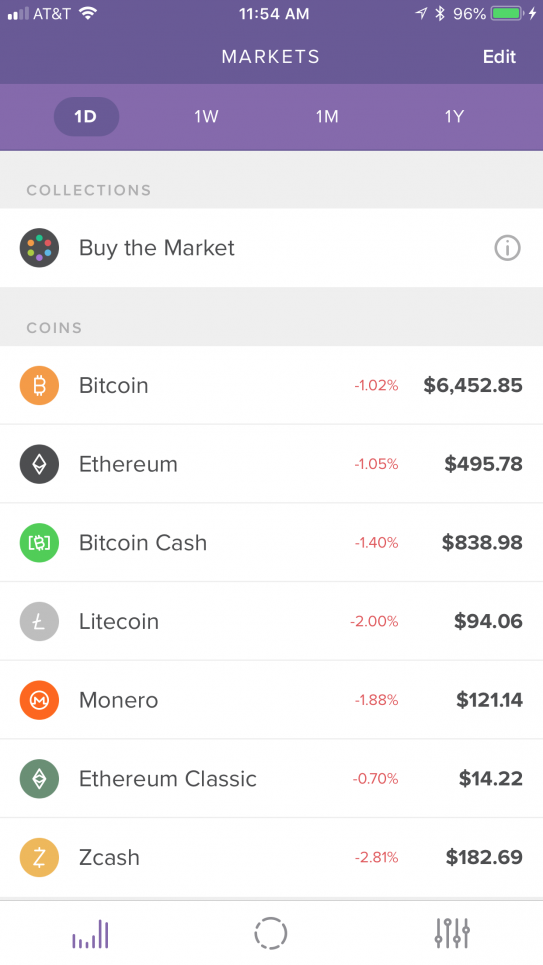

After registering, customers can either invest a sum of their choice (from $1) proportionately in 7 available currencies using the "Buy the market" option or choose their own investments.

Circle offers access to the following crypto-currencies: Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, Litecoin, Monero and Zcash.

However, Circle's potential USP is its ambition to become a global transaction platform.

With Goldman Sachs' support, the start-up is actually aiming to apply for a federal banking license to offer customers more services. Circle also plans to remain registered as a brokerage and trading site with the Securities and Exchange Commission (SEC), to help investors buy and sell tokens by reducing the risks relating to all the regulations in the US.

SQLI Lab NY's opinion:

This application lets crypto-currency newbies get started easily and at virtually no cost. You can start with a dollar and all the information provided on each virtual currency is really handy: the official website, the Twitter account, plus all the data needed to properly understand both it and blockchain technology.

In the highly-regulated finance and investment sector, US fintechs offers customers a range of options to diversify and take charge of their stock portfolios. The sector is currently growing fast because banks understand that these start-ups offer customers new (and often better) solutions and a fresh approach. The US financial markets offer an interesting entry point to the world of banking for these start-ups that want to compete with financial institutions.