CREDIT AGRICOLE NEXT BANK

Loan offers – Crédit Agricole Next Bank: Agreement in Principle in 20 minutes

What if you didn't had to go to your local branch to acquire a mortgage offer for your primary residence? What if you could have your unique financing plan and agreement in principle in less than 20 minutes with just a few clicks?

The ideal has come true for Crédit Agricole future bank, thanks to its steadfast commitment to improve its digital services, allowing clients to choose their preferred channel of connection with their bank and providing them with a tool that represents their habits and expectations.

A large-scale project

“At the end of 2017, in line with Crédit Agricole next bank’s strategy, we launched the “Online mortgage response” project. After approving the project’s framework, we took the time to draw up a clear and very precise set of specifications.” explains Emmanuel Favrat, Project Manager, Crédit Agricole next bank.

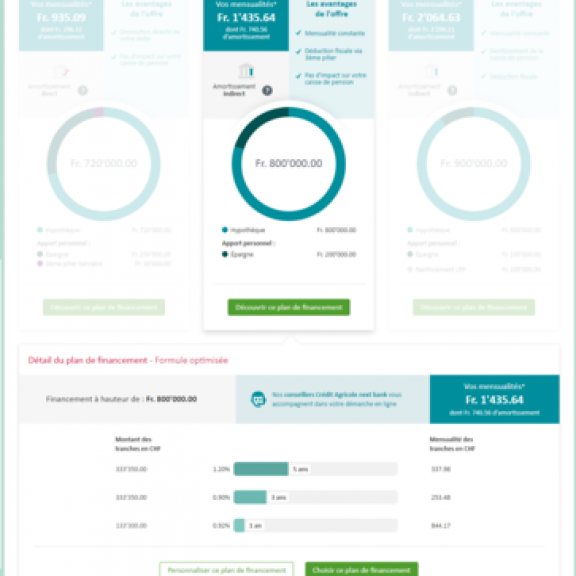

“Even if the bank proposes a wide range of mortgages, we decided to initially offer just one option: buying your main home in Switzerland, excl. building work. Our approach was also guided by our firm commitment to provide a full online response perfectly suited to both the project and the customer’s objectives. More than just sending a message saying that an advisor will get back to them to finalize their financing plan, we really wanted to be able to offer agreement in principle, as well as allow the customer to choose from several financing solutions.” adds Grégoire Danielou, Digital Project Manager, Crédit Agricole next bank.

More than blindly following orders: skills, advice and expertise

Crédit Agricole picked SQLI Switzerland to assist them bring this project to reality after receiving an invitation to tender in early 2018.

“With SQLI’s teams, we were on the same wavelength as to the way we wanted to work. More than merely providing methods, we expected our partner to be committed, trustworthy, and on the ball!” says Emmanuel Favrat.

“What ultimately won us over was the fact that the project team had been working on a very similar project with another bank a few months earlier. As a result, they knew what they were doing and already had some relevant experience.” adds Grégoire Danielou.

“Even in the first few weeks, we encountered difficulties developing the user journey. The structure was highly complex: there were more than 4,000 possible routes… It could have jeopardised the project’s progress. SQLI wasn’t afraid to challenge us. Plans changed and they found a solution to reduce the workload and complexity of the developments. They didn’t just blindly follow orders - they were proactive and advised us.” underline Grégoire Danielou and Emmanuel Favrat.

The first models we showed to the bank in-house allowed us to make steady progress on the rest of the journey while also emphasizing the UX aspect.

“One of the key challenges for Crédit Agricole next bank was to make the process as smooth and enjoyable as possible. You have to put yourself in the user’s shoes: what will make them stay the course? The questions need to be simple and clear, the information structured and logical, the answers must not require too much writing but rather selection of auto-filled answers, etc.” explains Jean-Sébastien Jacquet, Project Manager, SQLI Switzerland.

“It’s true that we were particularly focused on the loan offer process and meeting the release deadlines. Of course, we wanted it to look good, but above all it had to be delivered on time.” adds Emmanuel Favrat.

“The finished product is very well thought-out, stripped of any information that would slow down the process.” Grégoire Danielou is happy to say.