Q1 2020 Turnover update on impact of COVID-19

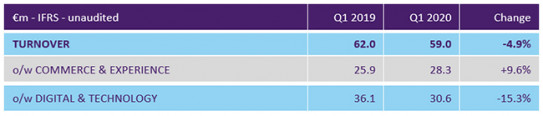

European digital services group SQLI posted Q1 2020 consolidated turnover* of €59.0 million, down 4.9% compared to Q1 2019.

This reflects a brisk start to the year for Commerce & Experience and the expected contraction of the Digital & Technology business, followed by a substantial decline, particularly in France, in the second half of March due to the emergence of the health crisis. Recently acquired Redbox Digital, an e-commerce agency based in the UK and Middle East, has been consolidated since 1 March 2020 and contributed €0.7 million to Q1 turnover. On a like-for-like basis, quarterly sales fell 7.0%**.

Commerce & Experience - International expansion

Commerce & Experience, which brings together the European digital agency operations, posted solid growth of 9.6% in Q1 2020, still in line with medium-term goals and mainly driven by e-commerce.

Q1 was marked by the acquisition of Redbox Digital. This instantly accretive acquisition has strengthened the Group’s international coverage (2019 revenue of €7.3 million generated in Europe and the Middle East), expanded the portfolio of key accounts (including AXA Insurance, Nahdi Medical, Nespresso, Fortnum & Mason and Universal Music Group) and positioned SQLI among the 10 Global Elite Partners of Adobe/Magento, the world’s leading e-commerce platform. It also shows the Group’s determination to play a unifying role in the European digital agency market, in accordance with the ONE FORCE 2022 plan.

Commerce & Experience also expanded its business considerably in France (Boulanger, Soufflet), where the first few months of the new sales organisation have shown promise, and in the international market (Brutélé, Carlsberg, Colruyt), where the Group signed a new contract with major client Nespresso. International business accounted for 84% of the division’s quarterly revenue.

Digital & Technology

Digital & Technology sales fell 15.3% in Q1 2020. In accordance with the strategic plan, in the first quarter SQLI continued to streamline its offering and discontinue non-profitable businesses as part of a process initiated in the second half of 2019. This policy led to a contraction in business, exacerbated by comparison with the particularly strong start to 2019 and the initial impacts of the health crisis, particularly in the aviation industry.In Q1 2020, Commerce & Experience accounted for 47% of the Group’s business (up 5 percentage points) versus 53% for Digital & Technology.

Trends and outlook

As soon as the lockdown measures were announced, a business continuity plan was successfully implemented, involving widespread use of teleworking in order to protect employees and ensure they could continue to perform their assignments. However, these measures, coupled with uncertainty over the duration and magnitude of the ensuing economic crisis, will have a significant impact on business in the second quarter of 2020, particularly in France.

Given the exceptional circumstances, SQLI has taken the necessary measures to mitigate the impact of the situation on its results, in particular via short-time working arrangements for around 30% of employees in France, adjustment in sub-contracting, a virtual hiring freeze and cost optimisation across the board. At 31 March 2020, SQLI had 2245 employees.

To safeguard its financial structure and prepare for the resumption of business under optimum conditions, the Group has negotiated a €25 million state-guaranteed loan with its banking pool (BNP, Banque Palatine, Caisse d’Epargne and Société Générale) with the support of LCL. SQLI confirms its decision not to pay dividends in 2020 in order to allocate all financial resources to the company’s development.

As announced on 24 March 2020 in the 2019 results press release, SQLI prefers not to provide any quantified targets for 2020.

Universal registration document

The resolutions to be submitted to the General Meeting on 25 June 2020 will be approved by the Board of Directors on 7 May. The Universal Registration Document (URD), including the 2019 Annual Financial Report, is expected to be filed with the French Financial Markets Authority (AMF) and made available to the public on 12 May 2020.

SQLI will publish H1 2020 turnover on 28 July 2020 after close of trading.

* Estimated unaudited data

** Exchange rate effect: +1 pp / change in consolidation: +1.1 pp