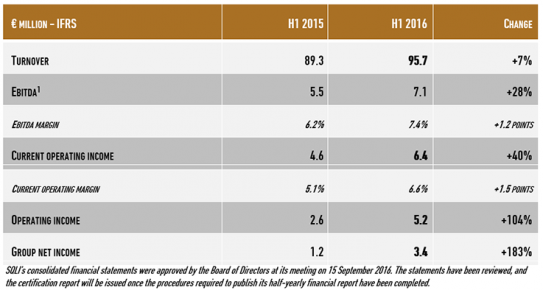

H1 2016 results : 183% increase in net income

A strategic shift towards high-end solutions and services and strict cost control delivered a strong increase in results for SQLI in the first half of 2016, underpinning the Group's target of another year of profitable growth in 2016.

SQLI reported turnover of €95.7 million for the first six months of 2016, up 7% on the same period in 2015. Growth was essentially organic and withstood a particularly high base effect (growth of 14% in the first half of 2015), despite the acquisition of InventCommerce's activities in April 2016 only making a marginal contribution.

Sales were primarily driven by solutions and services for major global names, with the Group enjoying a 23% increase in sales for top accounts and a 26% increase in sales for entities outside France (excluding non-strategic activities).

The strong impetus in the Group's flagship projects and its persistently strict cost control led to a substantial improvement in SQLI's financial ratios, with Ebitda increasing 28% to €7.1 million and current operating income increasing 40% to €6.4 million.

Non-current operating costs linked to the optimization of the Group's structure amounted to €1.1 million for a tax expense of €1.8 million. All told, Group net income for the period came in at €3.4 million, up 183% on the first six months of 2015.

Financial structure

This improvement in results also led to an improvement in cash flow (€5.5 million for the first six months of 2016 as against a figure of €3.3 million one year earlier), enabling SQLI to reimburse the balance on its bond loan (€3.4 million) and absorb the seasonal impact on its working capital requirement which was consistent with that seen in the first half of 2015 (€7.8 million).

At 30 June 2016, SQLI reported a cash position of €10.0 million, for a limited net financial debt of €2.9 million and €74.3 million in equity.

The Group also has access to a further €30 million in other sources of financing (outstanding warrants and options and credit line drawdowns).

New improvement expected in turnover and current operating income

After an excellent operating performance in the first six months of 2016, SQLI is looking forward to the same dynamic trend over the second half of the year. Backed by a larger team (400 hires in the first half and a target of 500 for the full year) and greater recourse to external partners (giving it the flexibility and expert profiles it needs), the Group will seek to continue to develop its strategic segment of major international names.

New acquisitions aside, the Group is targeting turnover of over €190 million for 2016, and a current operating margin of over 8% for the second half.

2016 should allow for a smooth transition between the perfectly executed Ambition 2016 plan and Move Up 2016 which aims to firmly establish SQLI as the European leader in connected experience by becoming the benchmark partner to tier one brands that use digital to drive customer experience. The new plan is also expected to trigger a new cycle of profitable growth as SQLI continues to adhere to its highly selective policy for new acquisitions.

SQLI will publish its turnover for the third quarter of 2016 on 9 November 2016 after the close of trading.

1/ Ebitda = current operating income + net depreciation and amortization and provisions