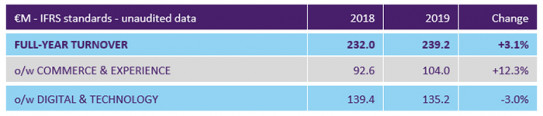

2019 turnover: €239.2M (Up 3.1%)

Double-digit growth for Commerce & Experience business and 2019 operating income

European digital services group SQLI today announces its consolidated turnover for 2019*. At €239.2m, yearly turnover rose 3.1% (2.7% like for like) driven by double-digit growth in Commerce & Experience business. With this strong performance and tight cost control, a double-digit growth can also be anticipated in 2019 operating income to be announced on 24 March.

Double-digit growth for the Commerce & Experience business

With full year organic growth of 12.3% (11.7% in Q4 2019), the Commerce & Experience business, which regroups the European digital agency operations, grew faster than the rate foreseen in the ONE FORCE 2022 strategic plan (8-10% per year).

Most notably, this business line passed the €100m threshold, underlining its position as one of Europe’s major players.Growth was fuelled by sustained performance among long-standing clients as well as new landmark deals in France (Intersport), Switzerland (Lycra, SGS), Benelux (Bridgestone, Brutélé/Voo, ForFarmers, Sligro), Germany (Mapal) and the UK (Radley).

The Group’s standing was enhanced by winning a number of awards, including the Episerver Partner of the Year Digital Experience , the Oracle Innovation Partner of the Year, the Digital Transformation prize, the LSA cross-channel Award and the Digital Solution prize at the Episerver Web Awards.

To support this growth, the business line’s headcount went from 616 employees at 2018 year-end to 662 at 2019 year-end, excluding service centre employees (688 at 2019 year-end, up 2.8% year-on-year) working for both business lines.

Operations streamlined in the Digital & Technology business line

The Digital & Technology business turnover fell 3.0% in 2019 (-9.5% in Q4 2019). Against the backdrop of a less favourable French digital services market in H2, especially in banking and insurance, the Group decided to streamline its operations at a faster pace to align it to 2020 perspectives.This led to headcount reduction (in branch offices, excluding service centres), which was brought down from 903 employees at 2018 year-end to 769 at 2019 year-end (down 14.8%).

Sustained growth in operating income

In this context, the Group expects a double-digit growth in 2019 operating income, which already rose from €4.5m in 2017 to €8.0m in 2018**.

Management strengthened

In order to ensure robust management of the Group's operational and financial activities as well as tight execution of the ONE FORCE 2022 plan, SQLI has made changes to its executive team. At the end of 2019, the Group announced the appointment of Olivier Stéphan as Group Senior Vice-President Finance (see 16 December 2019 press release). The operational and sales leadership of the Digital & Technology business was also adapted at the beginning of 2020 to restore a momentum in line with the ONE FORCE 2022 plan ambitions.

New major shareholder

The end of 2019 was also marked by DBAY Advisor, an international asset management firm with offices in London (UK) and Douglas (Isle of Man), increasing its stake in SQLI. With 28.59% of ownership, it has now become the Group’s major shareholder (see 18 December 2019 press release). Overseas institutional investors now account for almost half the capital stock.

DBAY Advisors, which underlined its support for the current strategy, had two representatives co-opted as directors at the board meeting on 30 January 2020.

Diederik Vos was CEO of SQS from 2012 to 2018. SQS is a leading provider of software testing and quality assurance services. He had previously held executive responsibilities at AT&T, Lucent Technologies, AVAYA and International Network Services. As a director of various firms, Diederik Vos has gained in-depth experience of the digital service sector.

Iltay Sensagir is a member of the DBAY Advisors investment committee. Graduate of EBS Business School (Oestrich-Winkel, Germany), Iltay Sensagir began his career at Goldman Sachs, at the Investment Banking Division in London. He was formerly at Kartesia, an investment fund active on several markets in Europe.

SQLI will publish its 2019 full-year results on 24 March 2020 after close of trading.

* Estimated unaudited data

** Including €0.4m related to the application of IFRS 9, 15 and 16