2019 Annual results Solid earnings growth

European digital services group SQLI presents its full-year results as approved at the Board of Directors meeting on 17 March 2020 chaired by Philippe Donche-Gay.

The statutory auditors have conducted their review of the full-year financial statements. The certification report will be issued upon completion of the requisite procedures for publication of the 2019 Universal Registration Document.

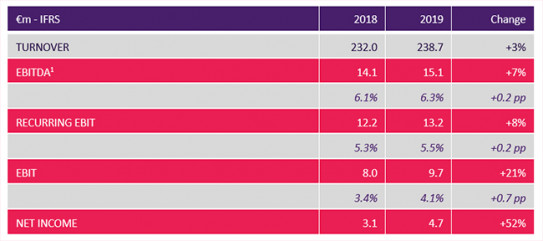

Ebit up 21% and net income up 52%

At €238.7m(2), , yearly sales rose 2.9% (up 2.5% at constant exchange rates), due to double-digit growth in Commerce & Experience (up 11.3%). The European digital agency business now accounts for 43% of consolidated turnover versus 40% in 2018. Boosted by this shift in the business mix, combined with the initial benefits generated by the focus on streamlining organisation and processes in the French digital services business, Digital & Technology, EBITDA rose 7% to €15.1m and recurring EBIT rose 8% to €13.2m.

The recurring EBIT margin came to 5.5% of turnover, up 0.2 percentage points year-on-year.Meanwhile, in line with its roadmap, SQLI significantly reduced non-recurring result(3), down 17% in 2019 and halved in 2 years to €3.5m. EBIT came to €9.7m, up 21% year-on-year. Measures implemented in 2019 to streamline operations are expected to generate recurring savings of more than €1m on a full-year basis.After factoring in net cost of debt, down 17% year-on-year to €2.2m, and tax expense (€3.3m versus €2.0m in 2018), net income rose 52% to €4.7m.

Healthy balance sheet

At 31 December 2019, SQLI’s cash balance stood at €20.1m, underpinned by an unused factoring reserve. Net debt excluding IFRS 16 lease liabilities totalled €14.5m and amounted to 0.96 times EBITDA and 15% of shareholders’ equity (€94.7m).

Expansion of commerce & experience in the UK

The Group’s determination to play a unifying role in the European digital agency market, in accordance with the ONE FORCE 2022 strategic plan, is reflected in its acquisition, early March 2020, of Redbox Digital, an agency based in the UK and Dubai specialising in e-commerce and employing 80 people.This new, instantly accretive acquisition enables SQLI to enhance its portfolio of key accounts (including AXA Insurance, Nahdi Medical, Nespresso, Fortnum & Mason and Universal Music Group) and thus become one of the 10 “Global Elite Partners” of Adobe/Magento, the world’s leading e-commerce platform.In 2019 Redbox posted sales of €7.3m, growth of around 10% and a double-digit recurring EBIT margin. SQLI acquired 60% of Redbox’s share capital and has an option on the balance held by the management team, which remains fully committed to the Group’s business strategy and vision.

Trends and outlook

FY 2020 is the first year of the ONE FORCE 2022 plan which, backed by the growth of its two core divisions and the ramp-up of resources in its Digital Services Centres, should enable the Group to embark on a strong upward growth trajectory. SQLI thus forecasts consolidated turnover of over €280m by 2022 and recurring EBIT in excess of €22m by the same year.

The Group remains highly vigilant in the face of developments in the health crisis and its economic consequences. In the short term, a business continuity plan has been successfully implemented, including widespread use of teleworking in order to protect employees and ensure they can continue to perform their assignments.

However, containment measures are starting to have a noticeable impact on business volumes, particularly in France. The Group has therefore implemented daily monitoring of its employment rate and an action plan, particularly in response to the exceptional measures implemented by the public authorities, to safeguard its cash.

Given daily developments in the situation, SQLI plans to provide an initial review of the impact of the COVID-19 epidemic on its business when it publishes its Q1 2020 turnover. At this stage, in view of the significant slowdown in business, the Group confirms its medium-term ambitions but is not providing any quantified guidance for the 2020 financial year.

SQLI will publish Q1 2020 turnover on 28 April 2020 after close of trading.

(1) EBITDA = Recurring EBIT + net depreciation, amortisation and provision charges (excl. IFRS 16)

(2) €239.2m pre-audit estimate announced on 6 February 2020

(3) Non-recurring operating income and expenses