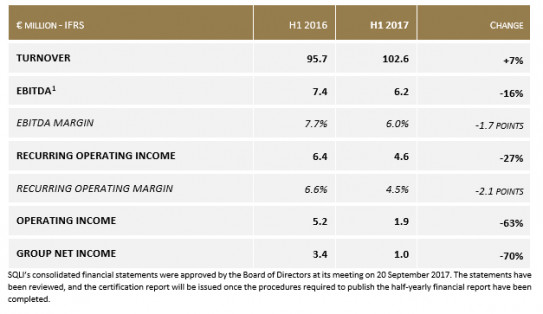

2017 Half Yearly Results

- Eighth half-year of consecutive growth (+7%)

- Drop in EBITDA (-16%) and in recurring operating income (-27%)

- Key acquisitions in Northern Europe

Activity

SQLI turnover increased 7% in the first six months of 2017, boosted by another sharp hike (over 35%) in strategic segments (omnichannel commerce, web solutions, mobility) and a more selective approach to assignments with a low value-added.

At constant scope, growth amounted to 5.6%, driven by:

- an increase in the number of large-scale assignments (each one involving over 50 engineers) in connected experience;

- the development of existing major accounts and new tier-one client wins (Arcelor, Michelin, etc.) for core business assignments;

- an increase in cross-disciplinary assignments (integration / data / web solutions / UX) and new expertise for Agile services;

- the development of cutting-edge products and services to reinforce the company's unique digital offer (security, operational chatbots, etc.).

Results

EBITDA for SQLI Group amounted to €6.2 million for the first half of 2017 (-17%), with recurring operating income coming in at €4.6 million (-27%). This decrease is explained by the costs linked to the transformation in the mix of activities in a period with a lower number of working days (1.2-point impact on margin). The Group has decided to accelerate the proportion of activities that will give SQLI a differentiating position in connected commerce, which in turn will mean a change in skills that will weigh on the employment rate.

The increase in the average daily rate (ADR) and the size of assignments were not sufficient to completely offset the weight of this transformation, prompting the Group to take measures to reduce costs to better absorb the impact as of the second half of the year.

Over the period, the company reported €2.7 million in non-recurring expenses, including €0.6 million linked to its HR policy, €0.7 million to acquisitions and €0.9 million to the future regrouping of all Paris entities on a single site.

Net income stood at €1.0 million at the end of June 2017.At 30 June 2017, equity stood at €77.3 million and net debt at €18.8 million.

Outlook

Organic growth in Switzerland and acquisitions in the United Kingdom (Invent Commerce), Sweden (Star Republic), Germany and Denmark (Osudio) mean that SQLI operations outside France account for over 30% of activity, with the majority of turnover generated in Northern Europe where margins are between 20% and 40% higher.

New acquisitions also mean an increase in the proportion of business linked to connected commerce, and will lead to new synergies between the products and services offered by the Group.

These latest developments underpin the objectives set in SQLI's Move Up 2020 plan of an EBITDA margin of 12% in 2020 and the establishment of the Group as a European leader in connected experience.

In the short term, the Group is targeting a sharp increase in EBITDA and in its recurring operating income in the second half of 2017 versus the first six months of the year.

SQLI will publish its 2017 third-quarter turnover on 9 November 2017 after the close of trading.

1) EBITDA = résultat opérationnel courant + dotations nettes aux amortissements et provisions