Venmo: the fintech that is making American banks sit up and take notice

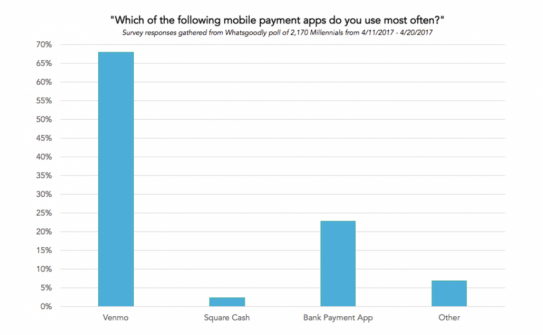

The favourite money-sending app among millennials is as widely adopted as Google and Uber.

Venmo: the champion of millennials

When people eat out, they no longer say: "Pay me back"; they say: "Venmo me". This simple service used to transfer money between users is making American banks sit up and take notice.

Source: https://lendedu.com/blog/best-mobile-payment-apps

Venmo is a mobile payment service belonging to PayPal. It enables users to send money to other users of the service via a mobile app. The sender and recipient must live in the United States. In the first quarter of 2018, transactions between users of the fintech app represented a total amount of more than USD 12 bn. Over the course of 2017, nearly 37 billion US dollars were exchanged via Venmo.

How does Venmo work?

Users create a profile on the mobile app or website using their bank account. They can find transaction recipients using their telephone number, username or email. Users have a Venmo balance for their transactions. They can link their bank account(s), debit card(s) or credit card(s) to their profile. Payment using a bank account or debit card is free, while credit card payments are subject to a 3% fee per transaction.

In the United States, when consumers use a debit card, the sum is debited from their account in real time. If they use a credit card, the purchase is billed subsequently. Venmo therefore charges a transaction fee when a credit card is used, as the money is not immediately transferred. If the balance is insufficient to make a transaction, Venmo automatically withdraws the required amount from the registered bank account or card.

Collaboration between Venmo and Mastercard

Users can also apply for a Venmo card that operates through Mastercard. The card offers ATM access and overdraft protection. It can be used anywhere that accepts Mastercard and allows withdrawals of up to $400 a day. There is, however, a $2.50 withdrawal fee at ATMs belonging to banks that are not partnered with Venmo. Also, the service includes a reload function that, when enabled, pulls funds from the user's bank account in $10 increments if the Venmo balance is insufficient to cover a purchase.

These features make the card similar, in many respects, to a conventional debit card. Users can track their expenditure directly on the app, which meets the preferences of consumers for digital banking tools, in particular millennials. In addition, the card can be personalised when it is acquired.

The social aspect: a major part of the Venmo service

When users make a transaction, the details (except for the amount) are shared on their feeds and with their network of friends on the app. When Venmo was launched, new users were encouraged to register via Facebook, which made it easier to search for contacts to send money to. At the same time, this enabled Venmo to market its service for free by appearing on users' news feeds.

Transaction notifications on the Venmo app are either publicly visible for all users of the app, limited to the user's list of contacts or totally private. All transactions are shared publicly by default. Confidentiality settings can be changed so that publications are shared only with the user's contacts or made private. Each transaction is accompanied by a description in the form of text or an emoji. This description is required to complete a transaction, but Venmo lets customers choose its form. Globally, 30% of transactions include at least one emoji. Entire studies have been conducted on the use of emojis in Venmo.

Users make payments in the same way they communicate with their friends, getting away from the seriousness of conventional banking apps.

What lies ahead for Venmo?

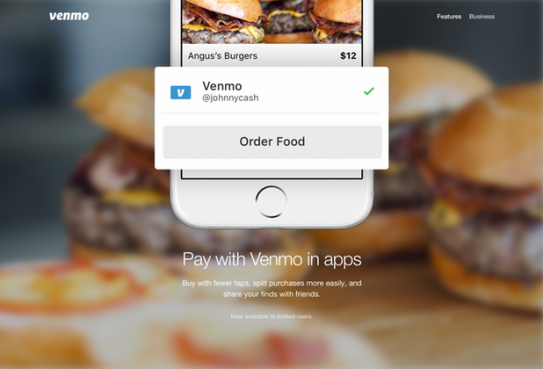

Venmo stands out for sharing information about payments with a list of user contacts, but it is not a social network in the same way as Facebook or Twitter. The company's revenue comes from transactions made using credit cards and, eventually, it could monetize its social space. Last summer, Venmo signed partnerships with a dozen brands, which enable users to pay for purchases and orders directly with the app. These brands include the meal delivery service Munchery and the fast food chain White Castle.

Source: https://gomedici.com/

This is where the social network aspect can come into play. If customers pay for a burger at White Castle using Venmo, their friends can see where they have eaten, like on Foursquare or Facebook. Venmo could therefore further profit from this brand visibility potential. Above all, the company has access to a wealth of information on the purchasing behaviour of its customers.

The payment app is based on banking infrastructure. If more and more brands accept payments via Venmo, banks will lose visibility of consumer spending information. They will only see requests from Venmo to credit or debit their accounts. Banks naturally fear Venmo's popularity. They have responded by launching Zelle. Zelle is a similar payment solution, but has two different features:

- Since it was developed by banks, Zelle appears in the money transfer tab of users' mobile banking apps. Transactions therefore appear in users' bank accounts in a matter of minutes, whereas with Venmo, this currently takes several days.

- Zelle does not have Venmo's social aspect.

Given Venmo's incredible popularity, as well as the growth and level of engagement of its user community, it is difficult to see it being overshadowed by Zelle.

This app's unique social structure has made it an unprecedented cultural phenomenon in the area of payments. Patience will undoubtedly be needed for PayPal's management to unlock its profit potential without harming the user experience. Venmo's main attraction is its ease of use, its low usage cost and the social aspect, which makes it easy to pay friends without having to specify an account number.

If PayPal wants to make this tool profitable, it will very likely need to increase revenue from stores. The risk is creating user discontent by filling their feeds with brand logos.