Paint It, Black - A report on Black Friday. Now more controversial than ever?

Recently, the topic of Black Friday emerged amongst a few of us colleagues at Star Republic. At first, talking about it relating to work and then in what ways the current pandemic might affect it. In the end, we ended up with a question, that it turns out, we didn’t have a clear answer for – how we really felt about Black Friday.

In recent years shopping holidays have grown both in number and in size. Immigrating from the world’s largest economies we first greeted Black Friday (which in many places has evolved into Black Week) and later Cyber Monday, Singles Day and with the emergence of Amazon.se, we suspect it won’t be long until we have Prime Day as well.

We asked around. And this is what we found.

In our discussion we asked ourselves if these shopping holidays were still relevant in the consumers eyes? Yes, we can all see the year-on year increase in sales, shipments and any other number indicating its success for retailers. But how do consumers really feel about it?

To find an answer we set about exploring the subject. But as our personal opinions on the matter differed by quite a lot, the subject needed a more empirical research before diving into detail. We decided we had to ask the experts.

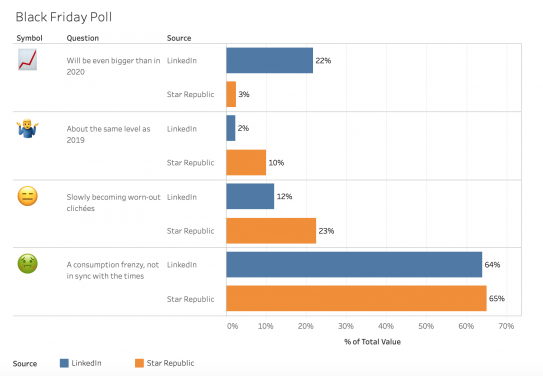

So as a start, we turned to ourselves and sent the question around the office, gathering answers from all of our colleagues. The question was simple: What’s your opinion on Black Friday in 2020? And with the question we had four alternative answers:

- A. 📈 It will be bigger in 2020

- B. 🤷♂️ About the same level as 2019

- C. 😑 Slowly becoming worn-out clichés

- D. 🤢 A consumption frenzy, out of sync with the times.

The result was pretty clear. Almost 87,5% had a negative view on the evolution of Black Friday, where 65% believed it to be “a consumption frenzy” and 22,5%“worn-out clichés”. Mind you that this is all opinions from a rather small group of individuals, all from within the e-commerce business. Even though the result didn’t tell us the opinions of the general public, it gave us a clear view of how we ourselves felt about it.

Opinions from the network

The next logical step was to step out of the office and ask the same question to the people in our network. We published the question above on our Linkedin. And yes, when we compare the results with those from our followers, there is a minor, yet significant difference. The negative side still represents a clear majority with 76% (options C & D combined). But on the other hand, a full 22% (or more than one in every five respondents) was instead of the opinion that Black Friday will be even bigger than before in 2020.

We believe that a significant difference in the two results may be due to the fact that many of our followers are from the e-commerce business, and as such see this as more of a business reality rather than an emotional point-of-view.

Because even if we at Star Republic are e-commerce experts, we tend to see things from the “user perspective” rather than from the “owner perspective”, as the understanding of the user experience is key to what we do.

But statistically speaking?

To get a less emotional, and more data-driven overview of things we went on the lookout for statistics that could show us where trends are going, also in numbers. A 2019 report from Svensk Handel (the Swedish Trade Federation), combining data from both their own research, as well as statistics from the government agency SCB (Statistics Sweden) gave us some interesting numbers.

First of all, Svensk Handel projected that 50% of all Swedes would make a Black Friday purchase, a number that increases to 70% when looking at consumers in the ages between 18 to 22. Even if it probably comes as no surprise to most people, Black Friday is still a “happening” for the younger consumers.

We can also see that one in every five e-commerce actors is expecting Black Friday to grow, a figure that was down from 37% the year before. If one compares that with the 22% from our own questionnaire, it would seem it has stayed roughly the same from last year.

Looking across the borders

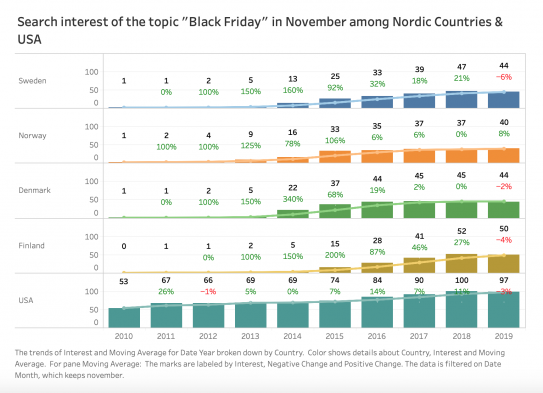

Black Friday is, as mentioned earlier, an imported phenomena from the US, and is still relatively new to Swedish consumers. If we are to look at our neighbouring countries here in the Nordics with shopping behaviours comparable with ours, comparing with the US market helps indicate where trends are moving.

There is no doubt that there are some very interesting insights to find if you are to look at Google Trends.

First of all, the negative trend we could spot in our simple poll can be found also in the Google Trend chart. In Sweden, a decline in search interest for the phrase “Black Friday” (-6%) is clearly visible, and with Norway as the exception (+8%), the same trend can be spotted on all the other markets we examined. Even in the US, the home of Black Friday, a negative trend is starting to show – albeit from extremely high levels. Please note that these are all 2019 figures, since 2020 has yet to be.

What to make of this

So, it would seem we’ve landed in somewhat of a contradiction. On the one hand, a majority of our respondents are stating that they “dislike” Black Friday, and with a corresponding change in our search behaviour to prove it. And yet, still at least 50% of all Swedes, including those we’ve asked for their opinions, will actually buy something on Black Friday. It seems like Erasure was right all along when they sang “I love to hate You”.

Paradoxical or not, while working on the matter, a number of conclusions have materialized:

Polarization

To start – it turns out people have pretty strong feelings towards Black Friday. In our questionnaire we used four answering options to not encourage the typically diplomatic Swede to go for the safe “middle way”, but it seems to have been in vain since the answers were mostly polarized anyway, with the most replies belonging to the extremes. Black Friday is obviously not just another excuse for the occasional sale, but a powerful and very polarizing shopping phenomenon, and the debate is probably just starting.

In the short lifespan of Black Friday it have gained a quite large and growing opposition, as more and more people are raising their voices, critizing it for encouraging massconsumption. We’ve started seeing a trend in companies and retailers joining in, boycotting Black Friday entirely and instead using the occasion to send a more sustainable message.

In Sweden, outdoor brand Haglöfs doubled their prices in-store and donated half of their income to the Swedish Society for Nature Conservation. In the US, campaigns such as REI’s #OptOutside that take a clear stand against Black Friday have proven very successful, and for those retailers who can navigate this quagmire in a smart way there might be large brand building gains to be made.

Growing scepticism

Black Friday sends a clearly negative message in times where over-consumption and its environmental impact are hot topics. The marketing messages from different retailers is weighted towards the consumption of as many things as possible, rather than how you can spend your money in a socially responsible manner and save a dime while doing it. The message is “buy more, whether you need it or not”, rather than “be smart, buy now and save some money on something you would buy anyway”. When in fact there are many factors that indicate that it is what the customers actually are doing:

Increasing sales or just re-distribution?

Because, another key takeaway from the aforementioned report from Svensk Handel is that if you compare the trends of the evolution of consumer income with their consumption habits you find a discrepancy. The general income increase of the Swedish consumer was +5,1% for 2018, but the change in sales of the retail sector was only +2,7%. And this was not only true for this year, the same thing could be said for 2019 as well as 2017.

This, combined with statistics showing that while November sales figures are increasing and that the same figures for December are instead shrinking, seems to imply that the total sales for the retail market as whole might not be growing at all. Instead, the consumers might simply be buying their Christmas gifts at a lower price – with lower margins for the retailers as an end result. This is also a great paradox, since single retailers might not have the option to simply stay out of the race to safeguard their margins simply because of the risk that their business might end up with someone else.

Black Friday “fatigue”

A common opinion we heard from our respondents when they could comment freely was that the general credibility of Black Friday seems to be in question for many. Widespread reports of raised prices prior to Black Friday is common, and therefore many sale prices might actually be perceived as a bit of a scam. In fact, the price comparison site Pricerunner states that price changes they see over the days leading up to Black Friday implies that almost 25% of all Black Friday offerings are scams like these. This also means, of course, that the remaining 75% are not.

But since the concept of Black Friday is co-owned by everyone participating in it, a lot of “innocent” retailers get smudged with the bad reputation created by others. The constant shower of Black Friday marketing messages is simply starting to weigh it down as customers start doubting their validity.

COVID-19 and Black Friday

Another common discussion regarding Black Friday is of course the current COVID19 pandemic that has put such a mark on the year 2020. Many respondents argued that industries such as fashion, beauty, travels and so on might have a hard time creating an interest with the consumers, as their products and services simply are not needed right now, no matter the price. Other products, such as digital services and improvements for your home (technical gadgets, gardening equipment, work-from-home equipment etc.) might instead do very well if they present deals interesting enough. Since we are spending more time at home right now, we want to make sure that they are as inspiring and comfortable to be in as possible.

Another influence COVID-19 might have is of course that some companies might be sitting on large inventories they have not been able to sell due to the changes in customer demand. If these inventories need to be sold off at any cost, it will mean potential big savings for end customers, but also enduring damage to the prices of the market in the near future. Not to mention the damage done to the companies balance sheets.

Predicting the future

In order for Black Friday (and other shopping holidays) to survive as phenomena, retailers need to be better at maintaining the events uniqueness—its USP if you will—that it’s a 24-hour opportunity of exclusive and limited deals. With that being said, it will probably become a natural part of our lives. At least until the next big thing comes along.

We also predict that larger e-commerce actors will follow in the footsteps of giants like Amazon and Alibaba creating their own, exclusive shopping holidays (such as Prime Day). As the competition and hype around Black Friday, Cyper Monday and Singles Day increases, creating your very own shopping holiday enables you to bypass the heavy competition and also enables you to create your own message and narrative.

Recommendations

- Be transparent with your pricing. Today’s consumer is no fool, and knows that he/she can find historical prices of the goods you are selling with the help of Google, or price comparison sites such as Prisjakt (PriceSpy) or Pricerunner. Failure to do so will not only mean damage to the general concept of Black Friday as such, but more importantly to the credibility of your brand.

- Use the 24-hour format to your advantage. Entice your customers with some initial, very compelling offers, and new ones during the day. Do not give all away at the same time, make sure that you (via the communication channels you have at disposal) can make the consumer return several times during the event. This also gives you the possibility to react to what your competitors are doing, and counter.

- Try to not hurt your Christmas sales more than necessary. We’ve learned that much of the Black Friday sales are actually cannibalizing on Christmas sales. Try to focus on creating offers on specific products that you fear might not sell as christmas gifts, and refrain from discounting products or, for that matter, entire categories you believe will sell in the upcoming weeks anyway.

- Find out what you feel about Black Friday yourselves, trust your guts, and act on that. It might just be OK if your opinion is more emotionally than financially biased. If you feel it, others are as well. No matter what, there are gains to be made from standing out from the crowd if you were to decide you’d rather not be a part of it.

Authors

Ola Linder

Competence Lead Content

Star Republic

Tobias Linnarsson

Content producer / Copywriter

Star Republic