Luxury brands in Asia have reinvented themselves

Following a drop in sales of approximately 25% during the first quarter of 2020, brands in the luxury sector have decided to experiment with new methods to attract an online audience and build loyalty in the face of the health crisis.

With online sales in the sector accounting for only 10% of total sales in 2019, according to McKinsey, luxury brands have sped up their transition to digital.

In Asia, China has been driving growth in the sector for several years, to the extent that Chinese consumers are set to represent 50% of the market by 2025, according to Bain & Company2. Hyper-connected Chinese consumers are therefore a core consideration. Digitisation of luxury brands is mainly happening through marketplaces, which are essential platforms in this country. With the pandemic, two underlying trends have emerged. On the one hand, brands have been led to use new channels, such as live streaming and online auctions. On the other, growth in second-hand purchases is encouraging them to rethink their products' life cycles. Furthermore, some brands are already using blockchain technology to improve the traceability of their products and, therefore, the buying and reselling experience.

Marketplaces: the emperors of China's luxury sector

Image of JD.com's 618 shopping festival. Source: pandaily.com

Have you ever heard of the '618 Shopping Festival' (618 stands for June 18th) It is a sales period in China, like the now famous Singles' Day. During the 2020 festival, luxury brands achieved the same sales in just half an hour as they did in one day the previous year, via the marketplace run by Chinese e-Commerce giant JD.com. On the Tmall platform, operated by its competitor Alibaba, 178 luxury brands took part in the festival, which is double the number of brands that took part in the last Singles’ Day festival in November 20193.

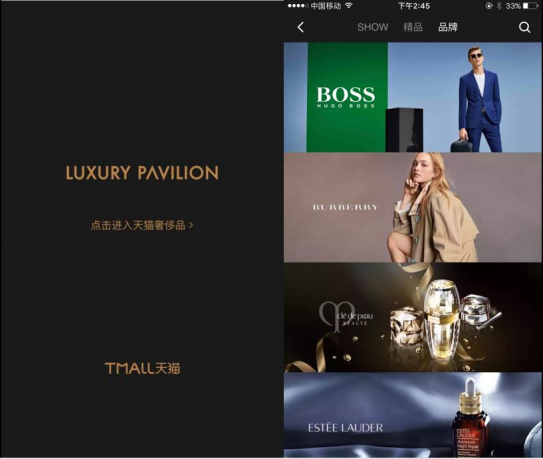

More and more luxury brands are creating stores on these platforms, after having attempted to focus on a Direct-to-Consumer (D2C) strategy aimed at maintaining total control over their image and prices. Marketplaces have indisputably become essential, particularly during the crisis period. Alibaba and JD have created specialised platforms to attract luxury brands: Tmall Luxury Pavilion and JD.com TopLife respectively. Here, the brands have dedicated luxury spaces, where there is a guarantee that their products will not be displayed alongside general consumer products. These stores also offer total freedom to personalize their interfaces, content, prices, and so on.

Tmall launched its Luxury Pavilion platform in 2017 in order to attract luxury brands.

Live streaming and online auctions: new boons for the luxury sector?

Luxury brands have also begun to experiment with live streaming, which grew massively during the health crisis as a new sales channel. Louis Vuitton was the first international brand to try out live shopping on the Chinese platform XiaoHongShu (also known as RED or Little Red Book) on the 26th of March 2020. The company chose a famous actress and fashion influencer to carry out this one-hour session, which was viewed 880,000 times4. These two figures shared their advice about accessories and ready-to-wear in the summer 2020 collection.

Another example: in February, during the Paris Fashion Week, the company Lanvin broadcast its 2020 autumn-winter fashion show as a live streaming event on Secoo, a Chinese e-Commerce platform dedicated to luxury. The audience was able to watch the show, which was commentated by a Paris-based Chinese influencer, using virtual reality headsets. The campaign was run in partnership with iQiyi, China's answer to Netflix.

Many fashion shows around the world were cancelled due to the pandemic. In March, Shanghai Fashion Week linked up with Alibaba to broadcast the show exclusively online, on the tech giant's dedicated platform, Taobao Live, making this Shanghai Fashion Week the first entirely digital fashion event.

Last May, the Asian subsidiary of the auction house Phillips carried out a sale of contemporary art pieces in Hong Kong, alongside luxury jewellery and watches. This cross-category auction was a first6. The health crisis obliged Phillips Asia to carry out this auction exclusively online, which also helped to attract younger generations. 90% of the lots were sold at the auction, with 56% of the buyers new to Phillips and 42% aged under 40.

Second-hand shopping and blockchain are forcing brands to rethink product lifecycles

The second-hand market is thriving in China, and elsewhere in Asia, and looks set to continue to expand after the crisis. Luxury brands will need to take into account the entire lifecycle of their products and rethink their distribution models in light of this new trend. Blockchain is the technology that could enable this change.

> Read our article on the growth of second-hand shopping in China

The Hong Kong-based luxury brand Lane Crawford is a pioneer in this area, encouraging its community to donate clothes that it resells in order to raise money for charity organisations and sustainable projects. It lets customers know the date of the donation, how long the item was previously worn, and in which city, by simply scanning a QR code. What's more, customers can access information about the environmental impact of their purchase: for each item, the amount of resources saved (water and CO2) is calculated and displayed following the product description. Lane Crawford does this via its own pop-up store, Luxarity, which uses a platform built on the blockchain Ethereum.

The brand Lane Crawford enables second-hand buyers to see the life cycle of a clothing item

More recently, Southeast Asia's leading second-hand luxury products platform, Reebonz, announced that it was working on a digital certificate with VeChain, a Singapore-based startup specialised in blockchain technology. The aim of this digital certificate is to enable customers to establish the origin of items bought. Since January 2019, all of the products in its inventory have a QR code that provides access to the product's details, origin and transaction history. While the project is still in the pilot phase, 50,000 products have been linked with a digital certificate since December 2019. The system also offers other advantages: it will enable Reebonz to achieve economies of scale with its authentication service and customers to revoke the certificate in the event of a theft.

As we have seen, digital is no longer optional for luxury brands. With the opportunities it offers in the areas of marketing and the circular economy, digital is an essential tool for brands to reinvent themselves and overcome the Covid-19 crisis.