Live streaming and social commerce: new forms of e-commerce in Asia

Over the past few years, two trends in particular have been growing in Asia: live streaming and social commerce. They are building on the strong presence of consumers on social networks, the popularity of real-time video and mobile payment services, as well as the fact that buying online is firmly established in consumer habits.

Live streaming: highly popular with Asian millennials

Screenshot of a BMW live stream in China at the beginning of 2020, via Taobao Live

Since 2016, live streaming has made a place for itself in the habits of millennials in China. Videos of amateur singers or celebrities sharing their daily lives are extremely popular among people in China, who are even prepared to send them "virtual gifts", which can be exchanged for cash. Riding on this wave, Alibaba broadcast a "See Now, Buy Now" fashion show for the first time during the 2017 Singles Day, its annual shopping event, which now achieves sales far greater than Black Friday. Broadcast as a live stream, the show enabled consumers to buy the latest creations of 80 brands, including Adidas, Burberry and Gap, which they could see on their screens on the Tmall platform in real time.

Since then, "live shopping" has continued to grow. The pandemic has given a major boost to this trend, even for businesses that previously had little reason to sell online, such as farmers, jewellers, and sellers of sports cars or property. Live streaming offers clear benefits: sellers can present their product(s) via video, answer consumers' questions in real time and even carry out live promotional offers to encourage them to buy products. It also offers a way to provide the brand experience remotely and reassure consumers about the quality and authenticity of products.

An influencer records herself at the premises of the company Hifan Multi-Channel Network in China

The influence of KOLs in Asia

Well before the popularity of live streaming that can be seen in China today, Key Opinion Leaders (KOL), or influencers dominated direct sales. In Asia, and China in particular, KOLs play a major role in digital marketing. 60% of Chinese consumers are prepared to buy a product marketed by a KOL they follow, compared with 49% in the United States and 38% in Japan[1]. One of the main reasons for this is a sense of insecurity surrounding the many scams, counterfeits and fake companies present in the country.

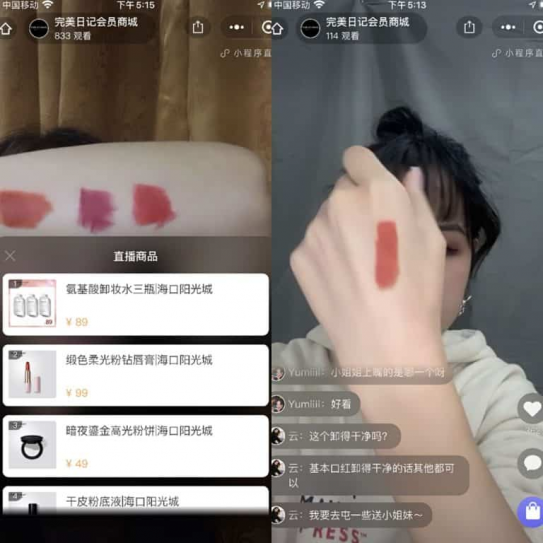

KOLs reassure Chinese consumers, making them more prepared to purchase from a new unknown brand. This is how Chinese brands like Perfect Diary have been able to make a place for themselves alongside big names, such as MAC, Maybelline and Dior, in just three years. The brand, which relies heavily on a social commerce strategy, was the first to use the new live streaming feature launched by WeChat during the lockdown. According to WeChat, the number of its visitors increased tenfold, and its conversion rate is three times higher than on other platforms.

Live stream by Perfect Diary on a WeChat mini-program (Source: MarketingToChina)

Alibaba is accelerating the adoption of live streaming by brands

Behind the live streaming trend, e-commerce giants are pulling the strings. In January 2020, Taobao Live, Alibaba's live streaming platform, recorded a 110% increase in its sellers' live sessions on its platform, in comparison with the same period the previous year. In February, following the outbreak of the Covid-19 epidemic, in order to speed up the involvement of brands, and other businesses such as farmers, Taobao opened up its digital services to a greater number of sellers by relaxing its conditions and removing certain fees.

The adoption of online sales by new businesses gave rise to a 719% increase in the number of users who used live streaming for the first time on Taobao, between January and February 2020[2]. In March 2020, Alibaba's main rival, Tencent, officially launched a live streaming feature on its platform, while its competitor JD.com, China's second largest e-commerce giant, announced a 10 million dollar investment in the development of its own live platform. Other Chinese platforms, such as Huya and Douyu, dedicated to video game live streaming, also saw an opportunity and introduced a shopping option in their respective platforms.

Brochure of the Shanghai New World shopping centre for its live streaming event in April 2020, which aimed to “put a smile back on the face” of its consumers.

Digitisation of retailers during the lockdown

During the lockdown, numerous live streaming events were launched by retailers in order to maintain customer loyalty remotely. For example, Shanghai New World, a luxury shopping centre in Shanghai, launched a three-day live event, over the course of which the various brands present in its establishment were able to present their products to the 130,000 connected customers. Certain retailers, previously reluctant to sell online, made the most of the situation to make their digital transition. Ideal, a traditional Chinese jewellers, made its transition following 18 years of traditional physical retailing by using its employees as KOLs. The brand encourages aggressive sales via live streaming by offering employees commissions of 10% to 50%, compared with 3% in shops.

Expansion in Southeast Asia

Alibaba is looking to encourage live streaming in the rest of Southeast Asia via the platform Lazada (the equivalent of Amazon in the region), which it has been investing in since 2016. Alibaba has launched several live streaming shows in the region during its past few Singles Days. In April 2019, Lazada announced it was offering 5000 hours of live entertainment-shopping for free in order to support Indonesians during Ramadan.

Lazada broadcasts Live Streaming shows in Southeast Asia

Social commerce: community purchases

More than 70% of China's generation Z prefers to buy products directly on social networks, while the global average is 44%[3]. Many innovative apps have therefore decided to ride on this trend and are providing e-commerce services focussed on social collaboration, such as grouping together with friends to get discounts, and exchanging opinions and advice. By adding the social dimension, these apps increase the engagement of consumers, whose trust in their social groups helps reduce fears and increase sales.

Brands are mainly joining this trend through WeChat, China's number one social application. By creating mini-apps in WeChat, they are able to use social sharing features. Thanks to WeChat, Perfect Diary managed to become China's third largest cosmetics brand in the space of just three years. The brand created a virtual character, Xiao Wanzi, who reflects the brand's target profile and plays the role of a beauty adviser and friend. Xiao Wanzi invites users to enter private groups on WeChat, through which the brand can freely communicate with them, with no charge. The brand has hundreds of private groups and each one has a manager who offers exclusive services to group members.

Focus on three social commerce apps with the wind in their sails

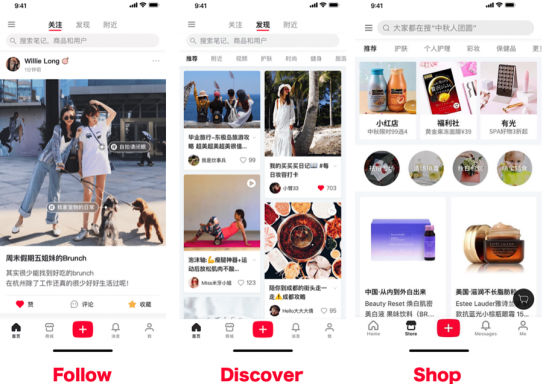

- RED: Pinterest-style shopping

With the application Xiaohongshu, or RED, users can post product review videos and photos. RED Mall, the related e-commerce platform, enables the sale of international products to Chinese users. The app had 300 million users in 2019.

Screenshot of the app RED

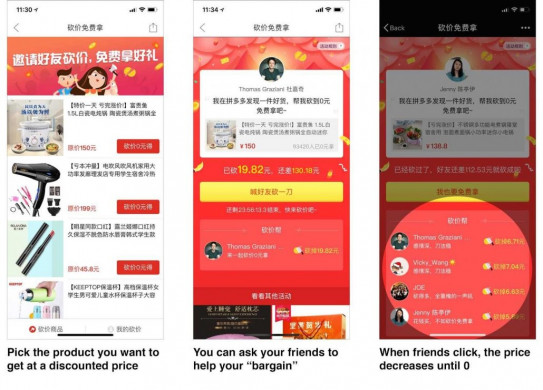

- Pinduoduo: promotional offers between friends

Pinduoduo has become China's third largest e-commerce platform, snapping at the heels of Alibaba and JD.com, thanks to its competitive prices, which are made possible by its social sharing features. Pinduoduo encourages users to form purchasing groups in order to get discounts, with product categories ranging from food to fashion. Following the economic crisis caused by the pandemic, the platform has gained further ground. Its penetration rate is thought to have increased from January to March 2020.

- Chilibeli: Grouped deliveries in Indonesia

Launched last year in Jakarta, the app Chilibeli encourages collaborative commerce by linking up farmers, logistics providers and consumers. "Agents" (mainly mothers) can create a group on the platform and add their friends. Orders are then delivered to the group's agent, who takes care of distributing it over the last kilometre. The startup has just received a 10 million dollar investment and says it has achieved 150% growth each month.

Chilibeli app - Google Play

Live streaming and social commerce offer increasingly direct interaction between brands and consumers, who are reassured about product quality, and can make fast and efficient purchases without having to leave home. Such consumption habits have been given a boost by the lockdown, encouraging even businesses that are very strongly attached to physical commerce, including product ranges that are more difficult to sell online, to initiate their digital transition in order to maintain contact with their customers. Similarly, people in the over-40 bracket have greatly contributed to the growth of live streaming during the lockdown. 50% of purchases via live streaming have been made in this age group on certain apps[4]. It is therefore very likely that these consumption habits will gradually gain ground in Europe too, among millennials and generation Z.

[1] 'China’s Smart Retailing Pays Off' report, A.T. Kearney and Tencent Research Institute

[2] https://www.abacusnews.com/tech/shopping-live-streaming-apps-booming-china-thanks-covid-19-pandemic/article/3077962

[3] ttps://www.warc.com/newsandopinion/news/chinas_gen_z_relies_on_social_media_for_shopping/39204

[4] https://www.ww01.net/en/archives/40314