Food: what is happening in the areas of foodtech and agritech in Asia?

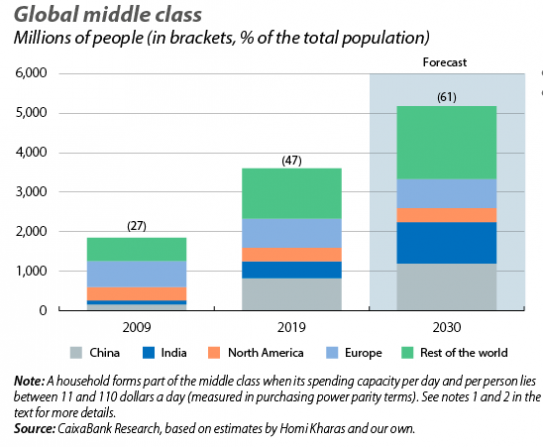

Growth of the world population, and the middle classes in Asia's emerging countries in particular, has led to an increase in demand for food.

Digital is now playing a role in food production, helping to improve crop performance, optimize resource use, connect farmers with the market and track food. We take a closer look at some of the players that are transforming one of the most ancient human activities.

Changing food needs

China and India are together set to bring an additional one billion people into the middle class by 2030, according to CaixaBank Research. China's emerging middle class has begun to reproduce western consumption habits, making it the biggest consumer and importer of meat at the present time1. Faced with this growing demand, the agricultural sector must innovate to produce more, while avoiding affecting consumer health and exhausting resources. A series of scandals in China have also created opportunities to make the food sector more transparent.

Elsewhere, the world population is migrating to urban areas (according to the United Nations, three quarters of the world population will live in cities by 20502). This is particularly true in Asia and the trend is making the supply chain to cities increasingly complex.

An issue highlighted by the closure of borders during the Covid-19 crisis, self-sufficiency has become a strategic challenge. Singapore, for example, currently imports 90% of its food from neighbouring countries. The Singapore Food Agency has announced its ambition to produce 30% of its food locally by 2030. The country is investing more and more in urban agriculture and innovations that make it possible to produce meat in labs, for example.

Urban farms: green in the city

In Singapore, Edible Garden City is shaking up the agri-food sector. This company has built a community linked to urban farms and created 200 food gardens over the past seven years, sometimes in iconic locations, such as the Marina Bay Sands hotel. It has helped farm-to-table restaurants flourish in the country. Edible Garden City also has its own farm, which integrates modern technologies, including a system that turns food waste into fertiliser with the help of insects.

Other urban farms in Singapore, such as Sky Greens and Sustenir Agriculture, have developed vertical production technologies in a controlled environment using LED technology. Sustenir Agriculture uses artificial intelligence to monitor plant growth and the agricultural system as a whole, from the raw materials to ERP.

The farm currently produces around 11 tons of kale cabbage a year on less than 50 square metres, and double the amount of vegetables such as lettuce3. Thanks to the closed and controlled environment, food grows faster, uses less water and produces twelve times less carbon emissions than imported products. By analysing data, the farm is able to identify exactly how to improve yields, from nutrients in the water to the energy used to produce light.

Sustenir Agriculture's LED lighting system. Source: www.straitstimes.com

Connecting farmers with demand: technology in the field

Technology is also helping farmers in rural areas improve their productivity and connect with customers. In India, for example, several startups have grown rapidly in recent years with a Farm to Fork?delivery model. They are helping the supply chain go digital and increase efficiency.

For example, Ninjacart, founded in Bangalore in 2015, has designed an application that enables restaurant and shop owners to order fresh produce directly from farmers, thereby cutting out the middleman. Transactions are carried out on the platform, while the logistics (delivery and warehousing) are then managed by Ninjacart, which takes a commission on each transaction.

The service is guaranteed paperless from A to Z. Ninjacart is currently able to make deliveries from the farm to the delivery location in less than 12 hours, with an efficiency rate of 99.88%. Thanks to its fifty or so warehouses, an army of "ninja" delivery people and demand prediction algorithms, more than 1000 tons of fruit and vegetables are delivered to 60,000 retailers in seven major Indian cities on a daily basis.

Due to very strict lockdown measures, most urban markets had to close. Retailers had to cease their operations and farmers, who make up most of Indian's working population, found themselves with harvests they were unable to sell. Ninjacart then launched the 'Harvest The Farm' campaign to directly link farmers and consumers, enabling producers to cover their costs and sell their harvests. Consumers also benefit with fruit and vegetables at low prices, while Ninjacart covers the cost of the supply chain. The startup worked with local delivery applications, such as Deliveroo, to make deliveries to the end customers.

The final farm-to-consumer delivery campaign deployed by Ninjacart during the lockdown in India.

Following this success, in 2020, the startup has raised 10 million dollars in Series C financing from Flipkart, India's e-commerce giant, and 50 million dollars from Walmart.

Supply chain transparency: a clear choice

Following a number of food scandals, China has become a pioneer in the area of supply chain traceability. In 2015, e-commerce giant Alibaba launched its HEMA (Freshippo) grocery stores, which integrate many new technologies, including a major innovation at the time: each product has a QR code that customers can scan to get information about the product, the supplier, the product's entire journey, its storage conditions, and comments from other customers, as well as recommendations and recipes.

With this technology, meat consumers can, for example, find out exactly when the animal arrived at the farm, when it was slaughtered, where it was transported from, and so on. You can even see the number plate of the lorry that transported it and food safety certificates.

Read our article on food safety and blockchain

The application for Alibaba's Hema grocery stores makes it possible to track the origin of products

Several startups in China are also focussing on product traceability by using blockchain technology. VeChain, a blockchain specialist aiming to improve supply chain management, is collaborating with Walmart China4. Sam’s Club, a chain of stores owned by Walmart that is dedicated to wholesalers and small businesses, is working on a project to use VeChain's blockchain to track the journey of 20 product categories for its brand Member’s Mark. The packaging will include a QR code enabling customers to access product origin information. The Singapore-based VeChain also has other projects in China, including for tea traceability.

Source: www.prnewswire.com

Asia is at the forefront of foodtech and agritech, transforming a sector that had changed little for thousands of years. The health crisis has further sped up an emerging trend towards more local and efficient production, mainly in cities, which combines increased transparency and a closer link between farmers and the market.