Brands are taking back control with the emergence of direct sales (D2C) in Asia

Direct sales, or D2C (Direct-to-Consumer), is a fast-growing channel in Asia and around the world. As brands increasingly find themselves dependent on marketplaces, such as Alibaba in China, D2C has become a strategic challenge to regain control of their customer relationships and data.

Direct sales to counteract the grey market

Switching to direct sales is no easy thing to do for brands in markets that are traditionally dominated by intermediaries, which are considered to be more reliable. China has popularised the use of "daigou", where trusted intermediaries are asked to buy brands' products abroad in order to bypass customs duties. 80% of products belonging to brands such as Unilever, Samsung and L’Oréal sold on marketplaces in Southeast Asia were sold by unauthorised intermediaries on the “grey market” in 2018, at a price that is generally 30% lower than on official websites1. These sales have a negative impact on brand image, as consumers' ratings on these platforms are 24% lower than for the same products on official websites. A tightening of regulations in recent years is limiting these practices, and should give a boost to D2C. For example, a new law passed in 2019 now requires those offering daigou services to obtain an official licence and pay taxes.

Marketplaces: a boon or threat to direct sales?

Asian marketplaces, such as Alibaba and Lazada, dominate e-commerce in Asia, similarly to Amazon in the West. These new digital intermediaries have a growing hold on brands. In addition to registration fees, which can cost up to 8000 dollars per year, Tmall, operated by Alibaba, and its competitor JD.com, take commissions of up to 6% on sales made via their platforms. Even social platforms, such as WeChat, are becoming a threat to brands, which increasingly depend on paid advertising through this channel. However, the real sinews of war is data and, when they sell through these third-party platforms, brands have limited data access. Alibaba is already beginning to commercialise this data with a specific consultancy service for new product development, called the Tmall Innovation Center, which will collaborate with brands such as Unilever, Samsung, Mars, L’Oréal and Mattel. Products recommended by the innovation centre are then exclusively sold on the Tmall platform for an initial period of two months.

JD.com offers a similar service, which it calls "Consumer-to-Manufacturer" (C2M), with clients including Huggies and Head & Shoulders for example. According to figures provided by JD.com, these brands sales' have significantly grown following its recommendations. On the basis of its sales data and queries made on its platform, JD.com has observed the growing popularity of Chinese baby nappy brands that use composite materials. Huggies has therefore launched a new range of products based on the same materials. Since then, sales of this range have accounted for more than 62% of the brand's total sales on the platform.

Three striking success stories

Nike

Nike's direct sales grew globally by 142% between 2015 and 2020, and the brand aims to achieve 16 billion dollars via this channel in 20202. The brand has reduced the number of its contracts with third-party distributors and invested in its mobile app and customer relationship. For example, the mobile app offers a product personalisation service called "Nike By You". Nike has successfully grown this sales channel: in 2018 alone, D2C accounted for 40% of its sales in China. In addition, now that it can exploit its own sales data, Nike has increased its investment in data science with the acquisition of the predictive analysis start-up Celect in 2019, enabling it to optimise its inventory.

Thanks to its strong customer relationship, the brand has succeeded in minimising losses related to the closure of its stores during the Covid-19 crisis in China. While it announced a slowdown in growth of 5%, online direct sales grew by 36%. This growth is in part due to its other mobile app: Nike Training Club. The brand made the premium version of its app free, which offers virtual sports training sessions, leading to an 80% increase in its use.

Nike's mobile app in China

Xiaomi The Chinese smartphone and connected device brand Xiaomi, which is often compared with Apple, has built its empire around a D2C model. Xiaomi began with an online sales strategy on its own platform, before opening its offline stores. Mi.com is currently the third largest online platform for smartphone sales in India, behind the e-commerce platforms Flipkart and Amazon3.

Perfect Diary

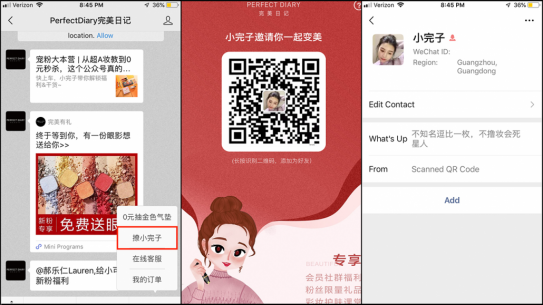

Perfect Diary is one of China's most innovative D2C brands, which has been valued at more than a billion dollars. Positioned in the cosmetics sector since 2016, the brand has firmly established itself, becoming the third best-selling brand, after MAC and Maybelline, in 2019. Behind this outstanding achievement is a strategy of direct sales via private groups on the WeChat platform. These groups are managed by virtual influencers that play the role of users' friends and advisers. This strategy has enabled the brand to communicate directly with consumers, without having to pay commissions to intermediaries. The brand recently made the leap to phygital and is now planning to increase the number of its physical stores in China from 40 to 300.

The Chinese cosmetics brand Perfect Diary's virtual influencer. Source: JingDialy

Love Bonito

The Singaporean fashion brand Love Bonito has become the most vertically integrated brand in Southeast Asia. Originally, the blog sold clothes purchased in Thailand and South Korea. In light of its success, the three founders rapidly decided to produce and sell their own creations via their blog Bonito Chico, which was renamed Forefront, hosted on the platform LiveJournal. In 2017, annual sales grew by 85%, while spending on marketing represented only 10% of sales4.

Forefront, the brand's blog

The success of brands that engage in direct sales in Asia is mainly based on their ability to use social networks, and offer quality content and additional, personalised services, via their own channels, in order to build a privileged customer relationship. The analysis of data to optimise their offering is also a success factor.

While it is an obvious course for new arrivals, D2C remains a challenge for more traditional brands. However, direct sales is a fast-growing distribution channel in China and around the world. It appears that by increasing their independence from marketplaces and offline intermediaries, brands are able to better understand consumers by being in control of data, launch new products that keep up with changing demand, strengthen the customer relationship, and reduce distribution costs, while maintaining control over their reputation.