How SQLI supported ASQ’s implementation of the ‘buy now, pay later’ provider that could transform the way customers shop online in the region.

“Sorry, we only take cash here. But there’s a bank a few blocks away.” Today, thankfully, most bricks-and-mortar stores have moved away from that once-too-common scenario.

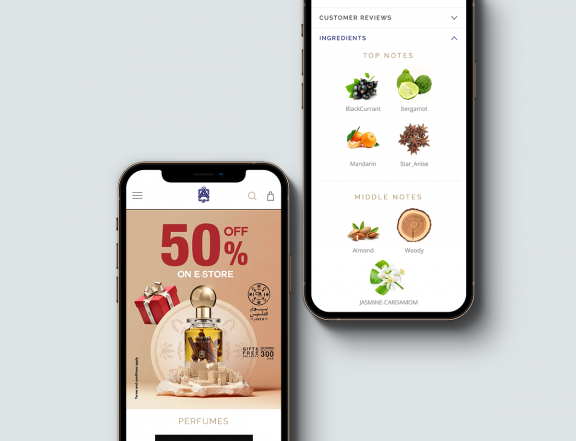

But when it comes to your online store, flexibility in payment methods is more important than ever before. With an average global cart abandonment rate around 70 percent, customers expect to be able to pay in an ever-increasing number of ways. Retailers must take note and integrate as many of these options into their business model and ecommerce site or get left behind.

Challenges

In the Middle East, digital retailers have further payment challenges to overcome due to a heavy reliance on cash on delivery (COD). This can be a more expensive option for retailers with higher risks of returned packages.

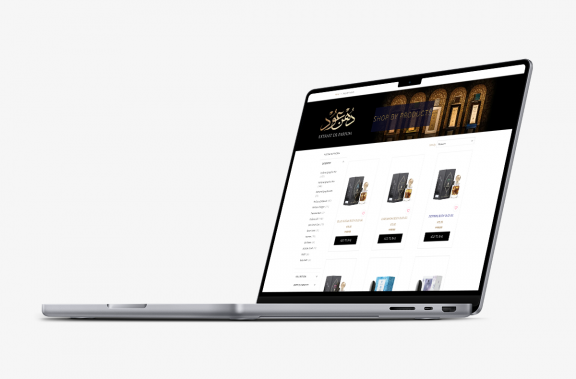

A recent partnership is set to change the payment landscape between SQLI, formerly Redbox Digital, client Abdul Samad Al Quashi (ASQ) – one of the biggest perfume and OUD retailers across the globe - and tabby, one of the first ‘buy now, pay later’ providers in the region.

tabby

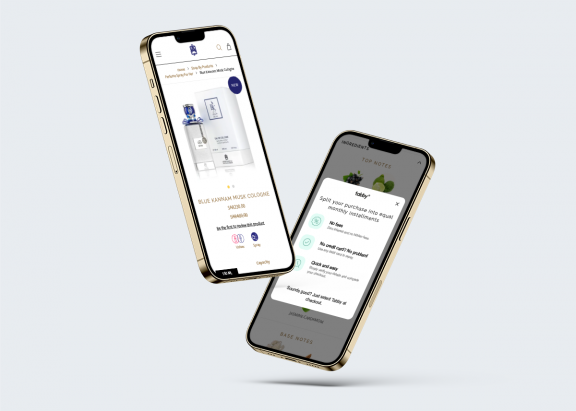

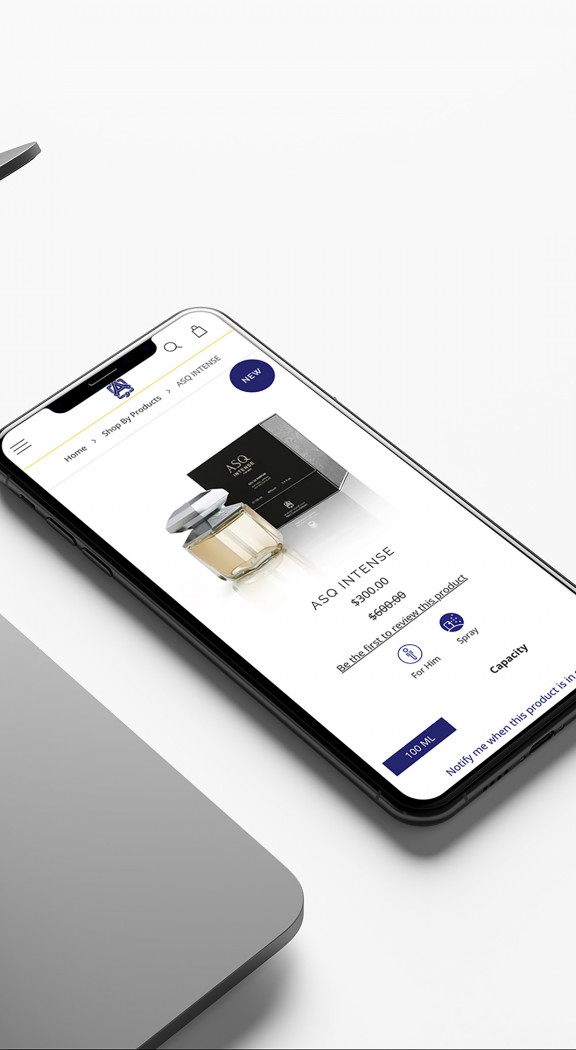

Tabby allows customers to make a purchase from a website and pay back in monthly instalments, or 14 days after delivery – allowing them to check-in without using a debit card.

A customer can be approved in seconds, through tabby’s risk assessment process, leaving the merchant to ship the order immediately. tabby pays the company when the goods are delivered and takes the money from the customer when the item reaches them by any number of usual methods.

"With any new service or technical-integration we are part of, it’s always a case of jumping into the unknown of how well it will play with Adobe Commerce and other customisations on the given website.”

The process gives merchants in the region new payment options for its customers while eliminating its own risks and logistical issues, something that could make a huge difference as countries start to move on from the COVID pandemic. It also allows customers to instantly check out without providing a credit card, one of the major concerns for customers when choosing COD for online purchases.

ASQ, which has been running on Adobe Commerce for over a year, turned to SQLI for support in improving and configuring the plugin for tabby. An open and responsive line of communication between SQLI and the tabby technical team helped resolve code conflicts and other issues quickly. It was viewed as a key factor in the successful delivery of the first Adobe Commerce integration in the region.

“With any new service or technical-integration we are part of, it’s always a case of jumping into the unknown of how well it will play with Adobe Commerce and other customisations on the given website,” said Joseph Degaetano, SQLI’s head of delivery, MENA.

“But while working closely with the tabby technical team, we were able to run a couple of short iteration sprints and provide the quality assurance testing. It resulted in a stable Adobe Commerce extension that has been successfully-integrated on ASQ fairly effortlessly and all parties were really pleased with the outcome.”

Tabby is now being used on ASQ’s online stores in the UAE and Saudi Arabia with the hope it could now provide the springboard for a change in online shopping habits across the region.

Firas Moazzen, ecommerce manager at ASQ, acknowledged: “Many customers use cash on delivery in the region, which is a challenge for e-commerce brands. “It means there isn’t any commitment until the last moment on delivery and customers can change their mind and return the product at that point. It creates many logistical issues for both the retailer and customer and many online brands would like to see this phased out.

“With tabby, it gives our customers different payment options and greater flexibility and resolves many of the logistical issues associated with COD. It’s early days, but we will work with tabby to promote and educate customers on the payment platform. We fundamentally believe that the more people know about it, the more popular it will become.”

Hosam Arab, co-Founder and CEO of tabby, added: “One of the biggest issues for our market is that most of our customers prefer to pay in cash which presents a huge set of challenges in terms of logistics. It restricts our choice of logistics partners in that not all of them offer cash on delivery and from a cashflow perspective, it’s not great. You also get a lot of returns.

“Through the platform integration, we can pull live order statuses from the Adobe Commerce back-end to make the process as seamless as possible and when the order is delivered, capture the payment and invoice the customer at that point in time. We pay ASQ once an invoice has been issued to the customer.

“All payment issues will be dealt with us. Any non-payment or default is a risk we bear. We are taking away all payment risks from the retailer.

“Through our payment platform, we hope to see a major change in the way people shop online in this region – it will be for the benefit of retailers and customers alike.”

SQLI believes giving customers the flexibility to pay by as many different methods as possible is important in moving e-commerce in the region forward. It expects many digital retailers across the Middle East to follow ASQ’s lead in the coming months.