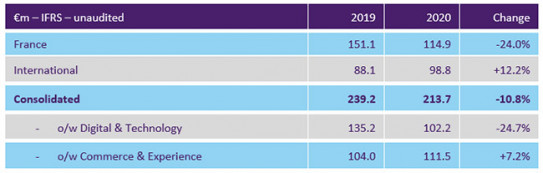

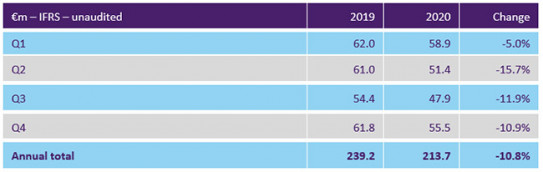

2020 revenue on target: €213.8 million

European digital services group SQLI announces its consolidated revenue for 2020*.

The Group closed the year with revenue of €213.8 million**, in line with its announced target of more than €210 million and reaffirms its goal of achieving 2020 current operating income above €6 million.

Double-digit growth in international revenue

In 2020, the Group’s activity was underpinned by the strong performance of its international businesses, which recorded revenue growth of +12.3% in the fourth quarter (€26.4 million) and +12.2% over the year (€98.8 million).

This increase was primarily due to solid sales in the European digital agency network, which generated organic growth of +3.8% in the fourth quarter and +5.0% over the year, driven by strong momentum in Switzerland and Spain. The Group also benefited from the successful integration of Redbox Digital, an e-commerce agency based in the United Kingdom and the Middle East, since March 2020.Sales outside France accounted for more than 46% of Group revenue in 2020, an increase of nine points in one year.

Gradual improvement in the utilisation rate in France

In France, business was heavily impacted by the health crisis, in particular in the Transport and Finance sectors, and by the streamlining of the offering since the end of 2019. Revenue in France totalled €29.2 million in the fourth quarter (-23.7%) and €115.0 million for the full year (-23.9%).

The streamlining measures and adjustments made in response to the crisis, including the use of the temporary unemployment scheme, together with the first effects of the sales recovery plan, were visible at the end of the year. After bottoming out at 75% in the second quarter, the utilisation rate rose to 78% in the third quarter and stood at 80% in the fourth quarter.

Careful management of the group’s financial structure

By continuing to keep a tight rein on costs and carefully managing its cash position throughout 2020, SQLI should report a sharp decline in net debt excluding lease liabilities (IFRS 16) at year-end 2020 compared with 30 June 2020 (€21.3 million), to a level close to that recorded at 31 December 2019 (€14.5 million), without making use of invoice factoring.

Positive early trends in 2021

The 2021 financial year that has just begun should enable SQLI to return to sales and financial performance trends more in line with its medium term ambitions.Internationally, SQLI will now benefit from its harmonised organisational structure and an acceleration in the integration of its recently acquired entities.

In France, the Group is expecting business to pick up from the second half of the year, after a likely decline in performance in the first quarter of 2021 due to the high basis for comparison. The profitability of its activities will be its priority.Against this backdrop, SQLI aims to achieve growth in revenue and current operating income in 2021. It will provide details of its goals when it announces its annual results.

SQLI will publish its 2020 annual results on 10 March 2021 after the close of trading.

* Estimated unaudited data

** -10.8% in reported data and -13.5% at constant scope and exchange rates (exchange rate effect: +0.2 point / scope effect: +2.5 points)