The Luxury story in the face of Covid-19 (Part I)

When you think of the luxury retail industry what comes to mind?

Personal assistants on hand in-store? A glass of Champagne while you try on some new outfits? Store design that goes over and above that of the high street brands, maybe? Goods that you can feel, touch, smell and instantly know you are purchasing something that is high-quality?

Now, consider how the COVID-19 pandemic has decimated the industry.

The crisis has hit the demand for luxury goods in many sectors hard, especially among Chinese buyers who have driven a high proportion of its growth in recent years. The virus has stopped the usual flow of cash-rich travellers from China to countries such as the UK and the USA, while also slowing down the rise of consumer spending in its own region. Chinese citizens accounted for 90 per cent of the global luxury market growth in 2019, according to Bain.

Perfume has taken a hit due to social distancing; fewer people need a sharp, new suit or handbag when they are working from the home office; high-end restaurants are taking fewer bookings due to lockdowns, or the restaurants spacing out tables; many shops have been forced to close on and off all year so are unable to roll out the ‘red carpet’ and give the personal touch in-store.

A report by Bain back in March expected luxury industry sales to fall by 35 per cent this year and although there was a bounce back during the late summer, the recent virus spikes across Europe have hurt businesses once again.

However, many brands reacted quickly and effectively at the beginning of the pandemic to ensure they remained operational. As a result, they were better prepared for the later second wave - and for any further disruptions going forward.

Innovation; exploring different market segments; investment in digital and omnichannel options; and finding different ways to bring the luxury experience to the homes of customers, have all been essential.

Redbox casts an eye over some of the talking points in the luxury sector during the pandemic and explores how digital is key to survival and growth.

Invest in digital now

Just a few weeks into the UK’s first Covid-19 Lockdown back in April, Brompton Bicycle announced some pivotal changes to its business strategy.

Firstly, the luxury fold-up bike brand said it was pedalling furiously into home delivery - giving customers the option of buying online and having the bikes delivered from the factory to their front door. Different payment solutions, including Redbox’s Buy Now Pay Later partner Klarna, would also give their customers more choice in how they paid.

Secondly, they allowed existing accredited dealers to offer this same service to their own customers too.

Up until then, Brompton Bicycle’s customers had bought the bikes from its bricks and mortar stores and were treated to the full Brompton experience. They could feel and touch the product, try it out for size, be given a demonstration from knowledgeable staff. With premium prices, many potential buyers wanted to see what they were buying and ensure they were getting the right one for their needs.

However, in light of the pandemic, the company acted quickly and decisively with their digital plans. Production initially dropped by 30 per cent as some suppliers shut down, but sales soon rocketed, with web traffic up by 62 per cent and five times as many online sales.

It is likely consumers will return to bricks and mortar in the long-term, but digital shopping habits that began during the pandemic are likely to be hard to shift.

In an interview with the Financial Times in June, Philippe Blondiaux, chief financial officer of French luxury fashion brand Chanel, said he expected a reduction in revenue and profit for the next 18 to 24 months due to the pandemic, but that the company wasn’t planning on changing its strategy of not selling its clothing, watches or handbags online.

Chanel are very much in the minority here. Many luxury brands have been re-adjusting their strategies or investing heavily in their digital operations. In many cases, plans for digital growth are being accelerated.

Gucci owner Kering recently spoke of signs of recovery for the company led by online sales. During the second quarter, e-commerce sales soared 72 per cent, with the company looking to improve its e-commerce and delivery capabilities and aiming to spend seven per cent of its revenue in operation improvements.

Chinese online retailer Alibaba is reportedly in talks to invest £232 million into premium digital fashion platform Farfetch as it looks to expand its presence in the luxury market. Farfetch shares have doubled in the past six months since news of the potential deal, which would be the company’s third major investment by a Chinese retailer. Its revenues rose 74 per cent during lockdown in the second quarter.

Partnering with premium brands like Fortnum & Mason over the years, Redbox has helped deliver transformation programmes across the digital landscape, addressing business goals (and challenges), including complex international requirements, growing payment expectations and ever-growing global customer base.

What can seem like a large financial outlay to step-up your digital game will be money well invested in the long-term. Don’t be afraid to be flexible in your approach, with retail partnerships, such as Brompton’s partnerships with accredited dealers, becoming more common and opening up new customers and important sales streams.

The luxury experience in the home

While many high street food chains turned to delivery or take out to survive Lockdown, for high-end restaurants things were harder. How do you recreate the ambience of a fine dining establishment? How can you replicate the service you expect to receive and can you really create and home deliver top quality food to the same high standards as found in the top UK restaurants?

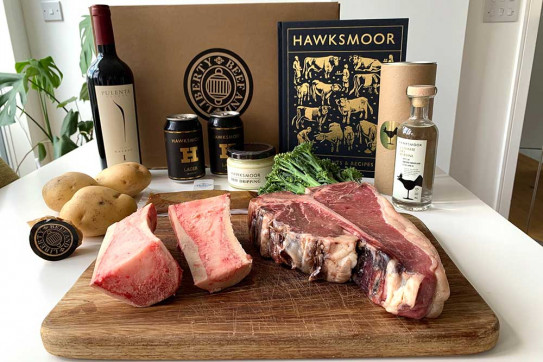

Premium steak chain Hawksmoor hit upon an innovative idea back in July with its Hawksmoor at Home solution.

Customers have been able to order a special meal box online that is delivered to their home to cook themselves. The Fillet Box, for instance, contains two large, British, 350g 35-day dry-aged, rib-eye steaks, bone marrow gravy, creamed spinach and chef Matt Brown’s Ultimate Oven Chips with nuggets of beef dripping. The group’s head of bars Liam Davy handpicks a fine wine, lagers and cocktails, such as a Negroni, to complement the meal, while a sticky toffee pudding with clotted cream for desert ensures an opulent end to proceedings.

The food itself is a treat, but it is also the unique detail and little touches that help bring the restaurant experience into the home and provide the personal experience-element that customers are looking for.

A Spotify Playlist allows diners to listen to a curated set of songs as they eat, while recipe cards and how-to videos featuring the restaurant’s chefs are on hand to ensure you cook your meal to perfection. The separate meal containers come wrapped in a special sustainable wool, while the meal boxes have to be ordered on a Monday by noon for Thursday or Friday delivery – and have limited availability – recreating the clamour for reservations at the restaurant and help to build up an element of exclusivity.

Luxury brands would do well to follow the lead of innovative businesses like Hawksmoor. No one knows for certain how long disruptions will continue through the pandemic, so it is vitally important to have a flexible approach that allows your business to switch to different operational strategies when needed, especially focusing on your digital solutions.

It is also vitally important to replicate the luxury experience for the customer throughout the user journey and unique, personal touches will help you stand out from the crowd now and reward you with brand loyalty in the long-term.

Think:

- Limited editions or time sensitive buys: Build-in an element of exclusivity to your online operations so that your customers will feel they are getting value for money and help build-up anticipation and excitement.

- Packaging: How can you make your packaging or delivery stand-out from the usual Amazon fare?

- Extras: What can you do to really set your brand apart from non-premium businesses? The little touches go a long way to creating unique customer experiences that leave a lasting impression and help spread word-of-mouth.

Thinking about the planet

While thousands have lost their lives, millions of people have also lost their jobs. For many, the pandemic will have a profound and long-lasting effect on what really matters to them.

After nine months of working from home, many consumers have gone without their usual fix of watches, handbags and expensive clothes.

Meanwhile, ‘Build Back Better’ is the phrase being spoken about by governments the world over. The lingering lessons of the pandemic are now merging with environmental issues looking forward.

Luxury brands often bear the brunt of consumer dissatisfaction when it comes to environmental issues, so with some shoppers now placing consumerism lower down on their list of priorities, it is essential brands take notice of their own carbon footprint, environmental impact and social consciousness.

With many stores closed and more digital shopping and delivery in its place, it is important to make a stand as a company, with Millennial shoppers often citing it as their main concern when supporting a brand.

Last year, fashion retailers and brands including Gucci and Kering signed a global pact to fight the climate crisis and protect biodiversity and the oceans. Luxury digital retailer Net-a-porter’s ‘Net Sustain’ section allows consumers to purchase products that have been ‘consciously’ crafted to meet attributes that take into account human, animal and environmental welfare.

If you haven’t already, it is time to commit to change. Can you cut down on package and waste? Can you partner with delivery firms that are investing in electric? Could you sell damaged goods or seconds for a discount on your site? Can you be more transparent about your supply chain? Can you give back to your community?

All of these options are important to today’s consumers and becoming central to their online shopping habits. They could help you thrive in the long-term, but are essential to start planning for now.

Time for change?

In summary, the luxury sector is at a major turning point in its evolution.

Before COVID-19, many brands were under pressure to adapt and change in the face of more multi-channel, digital-savvy consumers, and a growing march towards more sustainable options that reflect the future world they want to be part of. The pandemic has forced many brands to accelerate their long-term plans.

The more agile companies that invested early in robust, flexible omnichannel options, are the ones to look to for inspiration.

Digital is more important now than ever in the face of constant disruption to bricks and mortar stores. Brands in this sphere must pay closer attention to every single touch point on the user’s journey, especially in lieu of the developing changes to how we work and live. Many people are spending more time at home and on the internet than before and new consumer habits picked up over the past year could be hard to break.

Brands like Fortnum & Mason, Hawksmoor and Brompton Bicycle are among the innovative brands investing in digital solutions that can provide the flexibility needed and growth potential in this uncertain landscape.

Other companies in the luxury sector are ensuring they provide the same high level of service and experience that their customers are accustomed to in-store, by adapting and investing in digital solutions now. Move quickly and keep the trust and loyalty of those customers when the pandemic is over.

And while all this is playing out, companies must be hyper-aware of the growing calls to take their responsibility in global environmental matters seriously, or face the consequences as customers take their time and money elsewhere.

Lead from the front and reap the rewards as the ‘Great Reset’ begins to take shape.

In Part 2 of this series on the luxury sector, we will look at how content and personal experiences are changing in light of the pandemic - and what brands are doing differently to keep their customers engaged.