2018 Annual results: Higher profit & preparation of a new strategic plan

Successful Digital Experience positioning

The success of SQLI’s positioning on the buoyant Digital Experience segment was confirmed in 2018 by new client wins in the luxury (LVMH, luxury Swiss watches), financial services (Aviva, Axa and Generali) and retail (Autodistribution, Bridgestone and JouéClub) sectors.

SQLI also received a number of awards for its projects and, in particular, was designated by Forrester Research as one of 15 players in Europe who help companies to design, create and manage the digital customer experience within the context of their digital transformation strategies. SQLI is recognized for its ability to combine consulting, marketing expertise and technology.

Mixed performance by region

Overseas, where the Group is entirely focused on its new businesses and has successfully integrated its two most recent acquisitions (Star Republic in May 2017 and Osudio in September 2017), turnover increased by 30% (3% organically) to €80.8 million and recurring operating income was up 50% at €7.1 million. The Group’s recurring operating margin notched up by 4 points over the year to 9% of turnover.

In France, where the Group had to toughen its transformation measures, turnover increased by 1% to €151.2 million for recurring operating income down 37% at €5.1 million, resulting in a 2-point decrease in the recurring operating margin to 3%. The corrective measures put in place primarily to expand the Group’s headcount began to yield results in the second half of the year.

The Group recorded a solid 90 net new hires in the second half and ended the year with 2,238 employees (excluding interns).

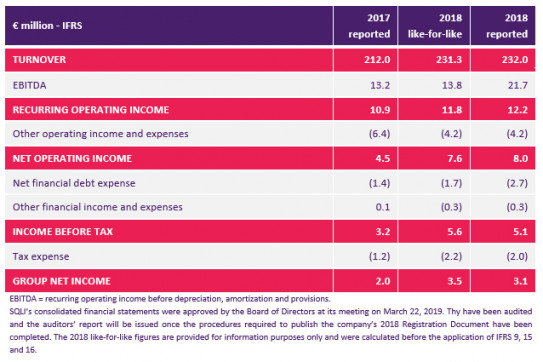

Improved results, boosted by new IFRSS

Overall, 2018 consolidated turnover rose 9% to €232.0 million (up 2% at constant scope and exchange rates) and recurring operating income was up 12% at €12.2 million. This performance was driven by the recovery in France, the growing contribution from overseas and the impact of the savings plan implemented in the second half of 2018.Net operating income increased by 78% to €8.0 million year on year. The improved operating performance was amplified by a marked decrease in non-recurring expenses (€4.2 million compared to €6.4 million in 2017).

EBITDA came to €21.7 million versus €13.2 million in 2017 boosted by the positive impact of the first-time application of IFRS 9, 15 and 16.Net of financial expenses (€3.0 million) and tax (€2.0 million), net income came in at €3.1 million, up 55% on 2017.The sharp rise in cash flow (€18.3 million versus €7.9 million in 2017) combined with the decrease in working capital requirement enabled the Group to step up the reduction in its debt.

At December 31, 2018, SQLI’s net debt stood at €12.8 million, half the December 31, 2017 figure of €25.6 million, with shareholders’ equity of €86.2 million. The gearing ratio was cut from 33% to 15% in the space of one year.

To preserve its strong financial leverage as it prepares its new strategic plan (see below), the Board of Directors proposes that no dividends be distributed this year.

Positive outlook for 2019

The Group expects growth of both turnover and earnings in 2019. SQLI should be able to support strong organic growth. Although the 2018 roadmap does not include any major acquisitions, the Group is continuing to examine potential targeted acquisition opportunities. This growth, combined with the full effects of the recovery plan in France, ongoing optimization and the growing contribution from overseas, will have a positive impact on its results.

This optimistic outlook is underpinned by a good start to the year, which should be reflected in the Group’s first-quarter 2019 results.

Preparation of a new medium-term strategic plan

Beyond its short-term success, the Group confirms its ambition of becoming a leading European player on the digital experience market and maintaining sustainable growth and improved margins. However, the external growth drivers have not been leveraged as anticipated since 2016 and the recovery in France took longer than expected. Accordingly, SQLI is preparing a new medium-term strategic plan to replace the current plan, which will be unveiled in early July.

SQLI will publish its first-quarter 2019 turnover on May 16, 2019 after the close of trading.