2017 annual results: a key milestone in becoming the european leader in digital commerce

Despite a decline in results in France, 2017 was another strong year for SQLI’s European network which expanded to include Star Republic in Sweden and Osudio in the Netherlands and Germany.

Today, the Group’s global footprint covers 12 countries, essentially in northern Europe.

SQLI’s consolidated financial statements were approved by the Board of Directors at its meeting on 27 March 2018. The accounts have been audited and the certification report will be issued once the procedures required to publish the company’s Registration Document have been completed.

Turnover up 11%

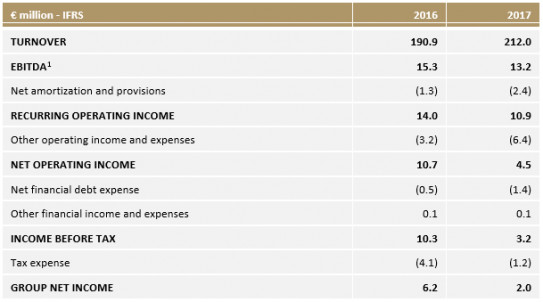

Turnover for SQLI increased 11% to stand at €212.0 million(2) for 2017. At constant scope and exchange rates, organic growth amounted to 5%.Growth in 2017 came on the back of a sharp increase (more than 35%) in services linked to e-commerce platforms and digital marketing and communications.

These strategic activities have seen an upturn in large-scale assignments (each requiring more than 50 engineers) and given the Group new wins with big names including Arcelor, Generali and Michelin.Activity outside France accounted for 29% of consolidated turnover (34% proforma(3)).

The average daily billing rate increased by another 4% to €476 over the year thanks to the company’s strong positioning.

Launch of an international organization

2017 also saw SQLI accelerate the launch of an international organization that has begun to make a positive contribution to profitable development outside France. Employee numbers in the services centers, and primarily the offshore base in Morocco, increased 22% (683 experts at the end of 2017) in order to accompany the level of business activity in all countries and substantially improve the ratio of average daily billing rate/employee on a growing number of projects. The successful integration of the companies recently acquired in northern Europe has opened the way for new synergies in terms of offers and experience.

Results impacted by the decline in activity in paris and the surge in investment required to ensure the successful launch of the strategic plan

The drop in EBITDA (€13.2 million compared with €15.3 million) and recurring operating income (€10.9 million compared with €14.0 million) is due to the under-performance of operations in France, primarily in Paris, and the over-investment needed to implement the Group’s strategic plan. Both factors weighed on the employment rate (drop of 1.5%), and a short-term action plan was set in place which led to an improvement in operating indicators between the first and second half of the year.

Recurring operating income increased from €4.6 million (4.5% of turnover) in the first half to €6.3 million (5.8% of turnover) in the second half of 2017.Net operating income (€4.5 million) included €6.1 million in non-current expenses, most of which was linked to the IFRS treatment of the relocation of all of the Group’s sites in Paris and the expenses linked to its acquisitions and one-off transaction agreements.

Restructuring costs remained stable on the previous year.Net of its financial debt expense (€1.4 million) and a tax expense of €1.2 million, SQLI posted a net profit of €2.0 million for the year.

Solid balance sheet and clear focus on shareholder returns

SQLI had a solid balance sheet at 31 December 2017, with €78.5 million in shareholders’ equity and a net financial debt of €25.6 million following the financing of the two acquisitions made during the year (cumulative investment of €24.1 million net of contingent considerations). The Group’s balance sheet factors in the positive results for the period and the potential gain to be had from the exercise of share warrants (BSAAR) maturing on 20 April 2018 (€5.4 million if all warrants are exercised).Given the exceptional circumstances, SQLI will not be paying any dividends. However, to underscore its commitment to shareholder returns without compromising its financial room for maneuver and the successful execution of its development plan, SQLI’s Board of Directors will propose the payment of one free share for 40 shares held to all shareholders. This distribution will represent a return of €3.7 million(4) for shareholders.

Move up 2020 plan targets confirmed and strong growth in results expected in 2018

SQLI will be targeting turnover of at least €240 million and an EBITDA of €20 million in 2018. To achieve its objective, the Group will be looking to develop a greater share of its turnover outside France, to continue to increase its average daily billing rate, and to restore activity for its Paris office through a series of different measures that are currently underway.

The Group’s operating indicators for the first quarter confirm an upturn in activity, and SQLI expects to see a substantial decrease in exceptional expenses.SQLI has also confirmed its target of a steady increase in EBITDA to up to 12% of turnover as part of its Move Up 2020 plan. The results expected between now and 2020 will contribute to cementing SQLI’s position as the European leader in digital commerce.

SQLI will publish its 2018 first-quarter turnover on 17 May 2018 after the close of trading.

(1) EBITDA = current operating income before depreciation and amortization and provisions.

(2) €211.7 million reported on 8 February 2018 (pre audit figures).

(3) Including Star Republic and Osudio over 12 months.

(4) Calculated on the basis of a share price of €38.